Evolve Credit launches cloud lending software, Configure

Africa has a credit gap of about $300 billion. And accessible banking and credit are needed now more than ever to close the gap. Evolve Credit, through Configure — its cloud lending software, is providing the technology to enable this to happen at scale.

Evolve Credit has launched Configure, a cloud lending software. Evolve Credit aims to power thousands of new loan providers with Configure over the next five years.

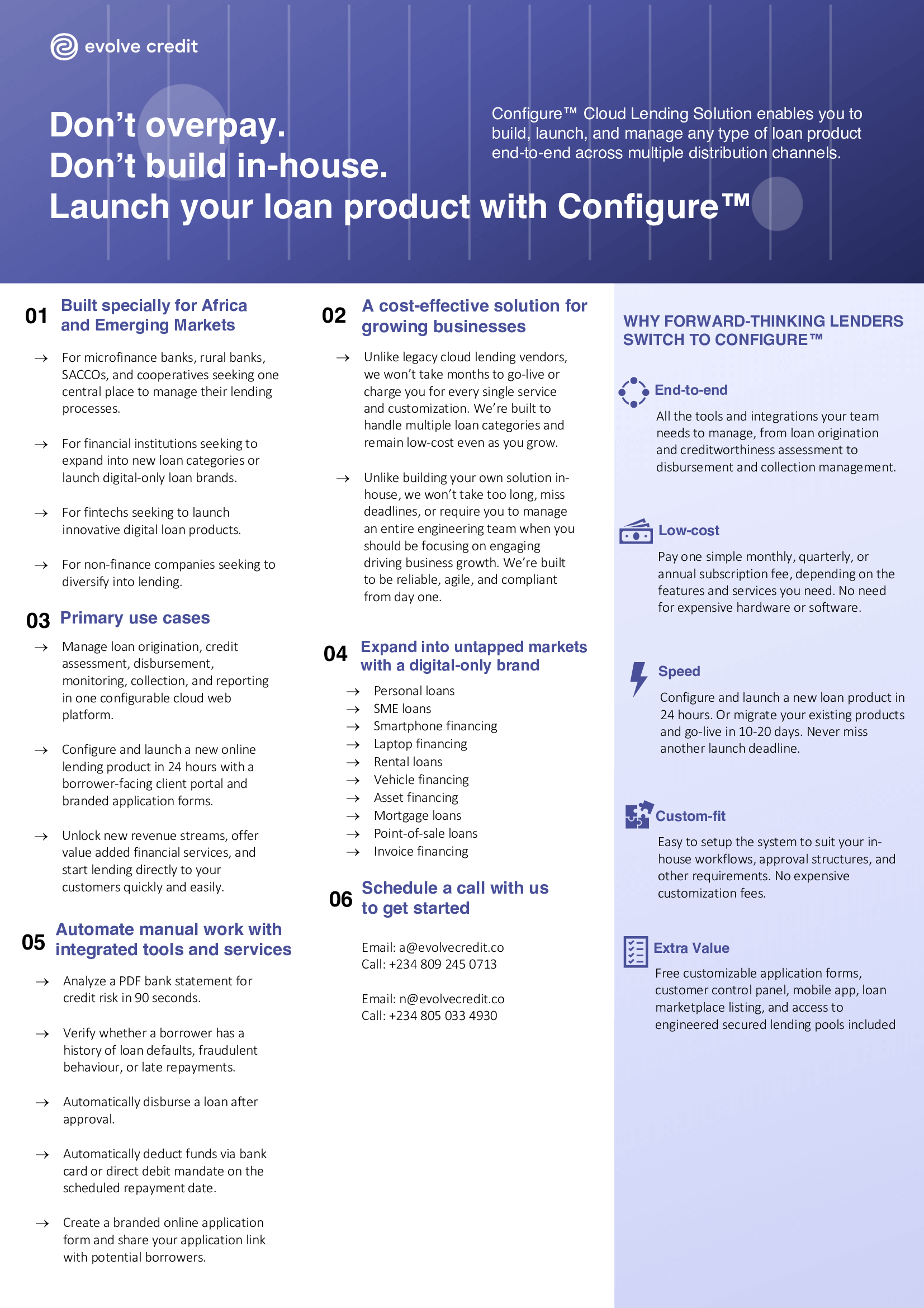

Configure is an affordable bank-level core lending platform that enables lenders to build, launch, and manage any type of loan product end-to-end across multiple distribution channels.

Speaking at the official launch of Configure on Tuesday, Evolve Credit Founder and CEO Akan Nelson said the company's vision has always been the same: to make access to credit and financial products more inclusive, accessible and transparent for millions of individuals and small businesses.

"We want to power thousands of new loan providers over the next 5 years; we want to make billions of dollars in credit available to millions of people and SMEs [small and medium enterprises]."

With rising income and a projected population of 1.7 billion by 2030, the annual spending of African consumers and businesses is expected to reach $6.66 trillion by 2030, up from $4 trillion in 2015. These trends are spurring growing markets in a range of sectors where Africans have unmet needs, including food, beverages, pharmaceuticals, financial services, healthcare, technology, housing, and education.

Africa has a credit gap of about $300 billion. And accessible banking and credit are needed now more than ever to close the gap. Evolve Credit, through Configure — its cloud lending software, is providing the technology to enable this to happen at scale.

Configure makes it easier and faster for microfinance players, upstart lenders, and non-bank providers (like telecommunication companies) to deploy credit products in days instead of months. Existing lenders can digitise their current processes in one-to-three weeks, as opposed to the six-to-ten weeks required by local and foreign providers.

Configure is built to be flexible and configurable. The cloud-based lending platform is able to support lending end-to-end — with frontend web forms, backend dashboards, and third-party integrations.

In short, Configure provides all the technology a microfinance institution or an upstart lender needs to operate like a big bank or a large online lender like Carbon.

Evolve Credit is betting that microfinance institutions will win the marketplace for the unbanked and bridge the massive credit gap in Africa. Evolve Credit also believes that their unique blend of deep local community expertise, personalized hands-on service, and accessible financial products gives them an advantage over other players.

Configure is already live with lenders in Nigeria and Zimbabwe, according to Evolve Credit. And using Configure, these lenders have originated and disbursed over $500,000 in loans since the private beta was launched in August.

As part of an early adopter program, Evolve Credit is offering a 20% discount to all new subscribers. To access the discount, simply email Joseph Andrews or sign up on the website.

Comments ()