Esports and its vast potential for the African continent

Esports has become a global billion-dollar industry, with more growth still to come. Africa is slowly catching up, with gaming competitions, celebrity gamers, and gaming communities springing up all over the continent. What is the potential for eSports in Africa?

Esports is now estimated to be a $2billion industry. Nowadays, professionals are forming competitive teams to compete in eSports competitions worth millions of dollars in cash prizes. Africa is slowly catching up on this trend and gamer communities and esports competitions are becoming more popular on the continent.

First of all, eSports should be distinguished from online gaming. Esports refers to professional and competitive video gaming in the form of competitions played by professional gamers. On the other hand, online gaming refers to playing video games online either by individual gamers or multiplayer sessions. Online gaming itself is a behemoth in its own right; expected to cross $196billion in revenue by 2022.

Esports is the competitive aspect of gaming. Much like conventional sports, the participants in eSports are superstars in their own right, with millions of loyal followers on social media and video streaming platforms like Twitch and Youtube. They participate in live matches that include teams of individuals and large audiences or bystanders.

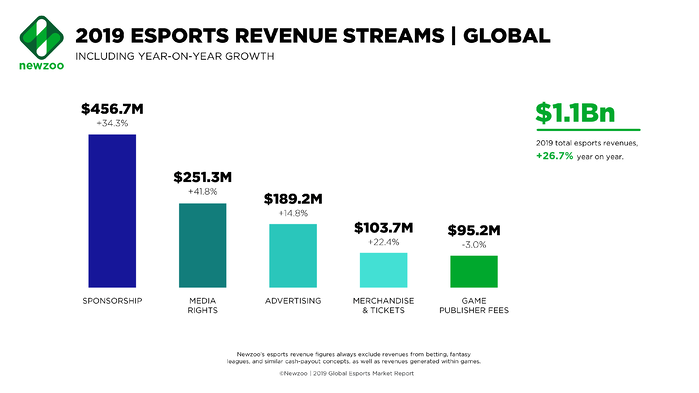

In 2019, global revenue from eSports topped $1billion for the first time. In 2020, despite the impact of Covid restrictions, more than eight eSports competitions were held, doling out millions of dollars in cash prizes, among other awards to participants.

The evolution of Esports

Video games have been mainstream since at least the 1970s, with the introduction of the first home gaming console, the Magnavox Odyssey or the“brown box” by Magnavox. Though they were the first relatively successful hardware gaming company, they did not attain sustained traction.

Atari was one of the first gaming companies to truly go mainstream and garner public interest in its products. The company was founded by Nolan Bushnell, acclaimed as the father of modern gaming. They pioneered arcade gaming and a loyal gaming fanbase when they released the first real electronic video game Pong, and arcade machines began emerging in bars, bowling alleys and shopping malls around the world.

This spurred real founder interest in home gaming consoles and hardware; in fact between 1972 and 1985, more than 15 companies began to develop video games for the ever-expanding market.

Esports and gaming competitions grew gradually as an after effect of this gaming culture and gaming communities. In 1972, the Space Invaders Championship held by Atari had an estimated 10,000 participants.

Increased internet connectivity in the 1990s led to the rise of online gaming and tournaments such as the Nintendo World Champions, QuakeCon, Professional Gamers League, and Cyberathlete Professional League

Since the turn of the century, eSports has gained real momentum. Tournament hosts such as the World Cyber Games and the Electronic Sports World Cup debuted, followed by the launch of Major League Gaming in 2002. Internet capabilities have exploded and computing technology has improved so much that each new generation of game is exceedingly better than the previous ones. According to the ESA Computer and video games industry report for 2015, at least 1.5 billion people with internet access play video games.

Networking services like Sony’s PSN have helped online multiplayer gaming reach new heights. Streaming platforms like Twitch also became growth catalysts by providing the stage for millions of viewers to watch their favourite teams and players live without leaving their homes.

The Esports Economy

Esports may have once been a subset of conventional sports, but now it has grown into a full industry in its own right. The global eSports economy was worth an estimated $1.1 billion in 2020, growing annually at about 15.7%, with $822.4 million in revenue coming from media rights and sponsorship alone. This revenue growth is up from an estimated $950.6 million in 2019.

Esports investments have doubled since 2018, going from 34 sponsorship and investments in 2017 to 68 in 2018, per Deloitte. The value has also increased to; investments have gone up from $490 million in 2017 to $4.5 billion in 2019, a staggering growth rate of 837%.

Another notable thing is that these investments are distributed across the ecosystem, from esports organizations, tournament operators and digital broadcasters.aming to the complex digital ecosystem it is today

Esports has slowly found its way into mainstream and pop culture, propelled through social media and video streaming sites. Video gaming streaming platforms like Twitch and YouTube give fans a direct connection to the players and teams, while more mainstream social media platforms like Twitter have allowed those connections to flourish.

Gamers like PewdiePie and Tyler Blevins have millions of social media followers and have net worth estimated at millions of dollars. In fact, PewdiePie is the third most subscribed channel on Youtube and is among the top earning Youtubers globally. According to SuperData forecasts, over a third of American eSports fans choose which tournaments to visit based on the the attendance of their star teams and players.

The more eSports competitions and celebrity gamers continue to integrate into pop culture, the more global investors, brands, and media outlets pay more attention. The industry is seeing a massive surge in investment from venture capitalists and private equity firms.

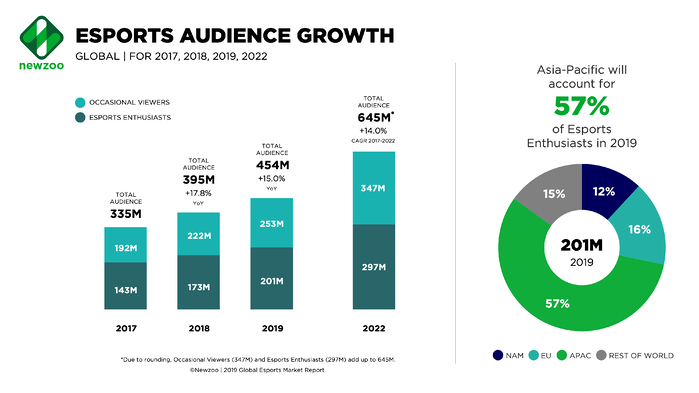

Globally, the total eSports audience grew to an estimated 495.0 million people in 2020, a year-on-year growth of about 11.7%. Esports viewership has grown at a 9% between 2019 and early 2021, from 454 million in 2019 to potentially 646 million in 2021. Emerging markets like Southeast Asia, India, and Brazil are primarily at the forefront of this growth, due to their huge population and growing consumer interest.

Asia, North America, and Europe are the top three esports markets, in terms of audience and revenue. Asia accounts for roughly 57% of global eSports viewership. North America raked in nearly $300 million in Esports revenue in 2020, with Europe reaching $138 million in revenue, per PwC estimates.

The rest of the world for now only accounts for about 15% of total esports revenue. However, one of the fastest-rising regions is Latin America, which made an estimated $18 million in revenue in 2020, which PWC projects to increase to as high as $42 million in 2021.

The prize monies and other cash rewards for participants in these gaming competitions are also getting bigger. The revenue and sponsorship is coming from notable brands like Mountain Dew, Red Bull, Coca Cola, Intel, Honda, T-Mobile and Audi.

Competitions like the Fortnite World Cup and League of Legends World Championship are some of the biggest annual esports tournaments, with millions in cash prizes to potential winners.

Epic Games for example pledged $20million for the 2021 Fortnite World Cup. Professional Fortnite gamer Kyle “Bugha” Giersdorf, then just 16-years-old, won $3 million at the 2019 Fortnite World Cup, making it one of the largest cash wins by a solo player in the history of eSports.

Esports in Africa

About 60% of Africa's population is under the age of 25, making Africa the world's youngest continent. The burgeoning youth population is a big opportunity for the continent, especially with the adoption of the internet and information technology among this demographic. Although Africa has just over 40% internet penetration, there is potential for growth.

In 2019 for example, more people in Africa accessed the internet than did in Latin America, North America, or the Middle East. There were 525 million internet users in Africa, 447 million in Latin America and the Caribbean, 328 million in North America, and 174 million in the Middle East.

As far as internet penetration is concerned, Kenya has the largest share among African countries at 85 percent; Libya follows closely at 84 percent, while Nigeria is third at 73 percent. Though Africa is behind only Asia and Europe in the absolute number of internet users, it lags behind every other region in the proportion of internet users.

Although there are few reliable sources of data concerning the current number of gamers on the continent. A Newzoo report suggests that there are over 700 million gamers in Africa, Europe, and the Middle East combined. This would mean that gamers in Africa would number in the millions, with potentially more to join in the near future.

Stephen Ojo, eSports enthusiast, strategist and founder of talent startup FusedUnisports tells Benjamindada.com that eSports is on the rise in Africa due to growing gaming culture and adoption of the internet. He points out that in December 2020, South African eSports athlete Thabo "Yvng Savage" Moloi made history by becoming the first-ever player from Africa to be sponsored by Red Bull. At just 18 years old, he is South Africa's top-rated FIFA player on PS4 and is ranked 73rd in the world.

He states further that tournaments like the World Connected Series in Africa, hosted in Lagos, is inspiring a new generation of gamers and gaming enthusiasts.

In March 2020, Nodwin Gaming, an Indian licensor and creator of eSports properties announced its expansion into South Africa with the opening of a new office. The firm has also invested in Nigeria and Kenya. With the South African video games market expected to grow to R5.44bn ($292m) in 2023, a vast talent pool of eSport players and fans is being nurtured in the country.

This growth is not without its downsides however. Issues like internet connectivity, sponsorships and gadgets represent a big competitive disadvantage to African gamers. This has forced African gaming talent like South Africa’s Bravado Gaming team to travel abroad for competitions and qualification tournaments.

The industry is starting to offer solutions around these problems. Ubisoft for example brought its servers online in South Africa, allowing local gamers to compete in international competitions.

What are the barriers?

Despite its vast potential, there are numerous barriers to the sustained growth of Esports in Africa. They include

- Broadband penetration

Broadband penetration is still quite low in Africa, and if esports is to really take off, up to date internet and cellular infrastructure is a necessary requirement. From the history of esports in western countries, one immediate factor that propelled its rise was the internet and how it promoted interconnectivity and community building. Although we are getting there, there is still a long way to go.

- An effective legal machinery

Contractual disputes between participants and tournament organisers can often happen. An effective legal machinery that addresses these issues is not quite there yet in Africa. Issues regarding intellectual property, trademarks, media, sponsorship, contractual disagreements and so on can only be resolved by litigation. The legal system in Africa has not really kept up with the times regarding this and more needs to be done in this regard.

- Sophisticated gadgets are also a big hurdle to cross, especially for African gamers. Esports requires sophisticated gadgets and electronics, which may be very expensive for African gamers.

- Sponsorship and collaborations are very important. As of today, only South Africa and Egypt are a part of the Global esports federation. It is also extremely hard for african gamers to qualify for international esports competitions. According to Stephen, game publishers and game developers in developed markets prefer to partner with Asians and rarely partner with Africans, which creates a significant barrier to sustained growth of eSports in Africa.

Comments ()