Earnipay is driving on demand pay in Africa

Earnipay's payroll financing solution helps businesses meet their payroll obligations on time, help employees access their funds in real time, and hence cut down the attrition rate to the barest minimum.

Abdul Muhammed is a content writer at a Lagos-based fintech that operates a hybrid structure, he earns about 150K monthly. Due to the fuel subsidy cut in Nigeria, he spent more on transportation and petrol to power his generator due to the unstable power supply in the country.

"With the subsidy removal, I had to spend more money than my usual budget," he says. "Coupled with my reoccurring [essential] expenditure, I wasn't able to save. Now I've run out of my salary even before the middle of the month."

Even before the subsidy cut, Abdul's story is relatable to several employees working in Nigeria. Minimum wage in Nigeria is currently pegged at ₦30,000. This major employees’ financial worry is a major contributor to why more than 80% of the working populace in Nigeria lives from paycheck to paycheck.

This dilemma usually pushes some employees to approach predatory lenders to be able to offset their daily expenses and emergencies. However, the loans come with exploitative interest rates which can plunge the employee into debt.

A solution businesses can use to tackle this problem internally is by allowing their employees to access their daily salaries as they work for it. This simple payroll method is known as on-demand pay, and it's an innovative solution that can promote a motivated workforce.

With on-demand pay, employees can access the wages they’ve earned without having to wait for payday. While the employees would have access to their earned wages at any time, the payment schedule remains intact, and the employer will be able to set maximum limits on the amount withdrawable.

On-demand pay can be the key to help reduce the attrition rate in your organisation while promoting your employee satisfaction.

Let’s face it: Life is happening to everyone a lot these days and most times, bills do not wait for an employee's 30-day salary window before they show up. So having the option of access to earned income could be a deciding factor for employees working in an organisation or jumping ship.

At the same time, adopting this payroll service can be a great retention tool for recruiters looking for ways to attract top talent during a time of great resignation and labour shortage. People are demanding more of employers, and they simply won’t take a job that doesn’t make it worth their time and energy.

We now live in a world where benefits equal compensation in terms of the emphasis new talents place on deciding where to work. Therefore, offering this benefit could give your company a competitive advantage.

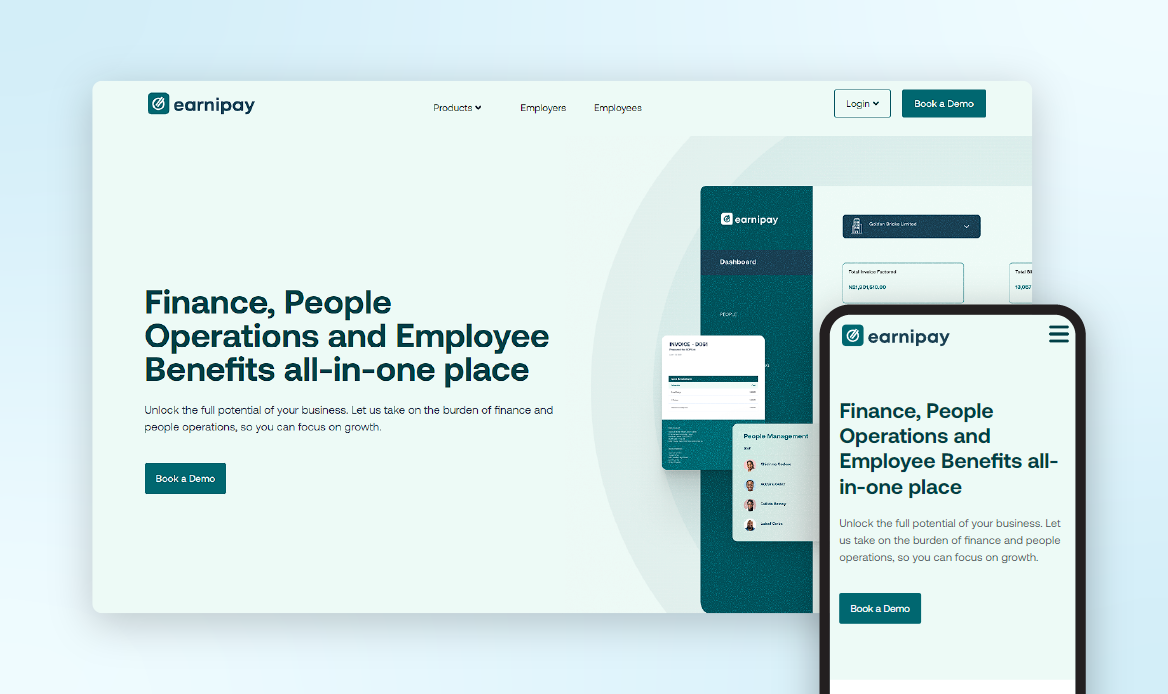

A Nigerian startup, named Earnipay, is at the forefront of implementing this payroll innovation. Earnipay's expertise and experience as a finance and people operations solutions provider for businesses in Africa, aims to improve the financial wellness of companies and their employees.

Although, on demand pay systems have long existed in other parts of the world like Branch, Zayzoon and Payactiv in Europe, Earnipay is one of the first movers in the Nigerian on-demand pay market. The company’s range of products seeks to improve employee satisfaction, productivity, retention, and overall business growth.

How Earnipay works is that employers share access to their employee data, specifically payroll data. Then the employers onboard their staff to the platform and this gives employees access to up to 50% of their accrued salary on any day of the month.

At the end of the month, the amount previously accessed is deducted from the employee's salary and paid to Earnipay and the employee gets what is left. Earnipay’s on-demand pay system is better than typical loan apps and salary advance schemes because salary earners on the platform get access to their earned wages at a flat fee.

Unlike advanced salary loans and loan apps that offer indiscriminate amounts with exorbitant interest rates, Earnipay users have access to the funds they have already earned and this helps them live within their means and make better financial decisions.

“My employees can request their urgent 2K [refers to ₦2000] when they need it. I find that loans are stressful to request for just 5,000 or more,” says Favour Eze, Head of people and culture at Thrive Agric.

This financing solution helps businesses meet their payroll obligations on time, help employees access their funds in real time, and hence cut down the attrition rate to the barest minimum.

According to Kehinde Ishie, the Human Resource manager at Tuteria Limited said, “Employees have quick access to their money because there would usually be many levels of approval for a salary advance. But Earnipay has cut all those off. For my employees, it is easy. I simply get an email that lets me know everything.”

“It was an avenue to give access to employees. They can have access to their salaries. We were looking for an avenue for our employees to be well taken care of, and Earnipay was an avenue,” Fiyinfoluwa Adeoti, People and Operations Associate, at Genesys Health Information System Limited, added.

Overall, the on-demand pay solution in Nigeria is expected to see significant growth in 2023, driven by the rising cost of living, inflation, and the need for talent retention.

In addition, employee financial wellness has become a hot topic in small and medium-sized businesses as well as large corporations, particularly since the post-COVID-19 era.

“Given the tough economic conditions,” Nonso Onwuzulike, the founder of Earnipay said, “where businesses are unable to increase salaries, employees waiting for 30 days to get paid is definitely going to affect their productivity, especially with an increase in their cost of transportation, feeding etc.

Giving them access to their earned salaries is an affordable way to fund their daily lives without them resorting to predatory loans, looking for multiple jobs or getting distracted at work. On-demand pay helps businesses keep their employees happy in these tough economic macro conditions.”

On their plans for the future, Earnipay intends to enable businesses to provide affordable benefits to their employees without breaking the bank. They’ll also help find ways to keep employees motivated by paying them better.

Onwuzulike said, “We are launching our payroll solution soon, and this is easily the most advanced and customisable payroll solution out there. Our bulk bill payment solution also helps businesses save money on airtime and data purchases. All our solutions are tailored to help businesses thrive and manage their people and finance operations.”

Comments ()