How to make money from cryptocurrency and not get scammed

In this article, I point out how you can make money from cryptocurrencies, and how to avoid getting scammed. For the purpose of this article, I focus on Bitcoin as it is the most popular and the largest cryptocurrency by market volume and value.

Cryptocurrencies have piqued the interest of many digitally-curious people looking for alternative investment opportunities. But their perceptions of cryptocurrencies range across two extremes: "Bitcoin is a scam" or it is "a get-rich-quick-scheme".

In this article, I point out how you can make money from cryptocurrencies, and how to avoid getting scammed. For the purpose of this article, I focus on Bitcoin as it is the most popular and the largest cryptocurrency by market volume and value.

How to make money from cryptocurrencies

While there are many ways to make money from cryptocurrencies, these three ways are the easiest and most popular: Hodling, trading, and decentralized finance (DeFi)

1. HODLing

Hodling is a play on the English word holding. It refers to the act of buying and keeping cryptocurrencies for the long term regardless of whether the price rises or falls. This makes sense because, despite the high volatility of Bitcoin in the short term, there is always an upward trend in its price (value) in the long term.

For instance, if someone in Nigeria bought one Bitcoin for $2,000 in 2016 and held onto it, their one Bitcoin today, June 17, 2020, would be worth almost $10,000. That’s a 400% increase in the dollar value. And because the Dollar has also gained value against the Naira over the hodling period, they would have successfully hedged against Naira depreciation too.

(The average exchange rate in 2016 was ₦258/$1 and today, June 17, it is ₦442/$1)

As you can notice, from the graph above, the price of Bitcoin rose and fell many times over a six-year period, but the general long-term trend still remained upward.

2. Trading

This is akin to the trading of volatile stocks. A lot of people make money by taking advantage of the short term volatility of Bitcoin to buy as prices fall and sell as prices rise.

While nobody can accurately predict what will happen to the price of Bitcoin, professional traders often carry out technical analysis based on market volume and price charts. This analysis helps them to understand the market trends and know when to buy and when they need to sell. Although trading is a skill that anyone interested can learn, it requires a thorough understanding of the market and the risks involved.

For most people; the regular folks and unlearned, buying Bitcoin in bits at regular intervals over a defined period is good enough. This strategy in traditional finance is known as Dollar-Cost Averaging (DCA).

3. Decentralized Finance (DeFi)

Because Bitcoin and other cryptocurrencies are borderless (there are no geographical boundaries to using them and no nation controls or restricts them), they are an easy way to access financial opportunities beyond your geographical location. You can save, invest, get loans, trade, and get insured from anywhere in the world. It presents a unique opportunity to shop for better interest rates and terms.

This means, while living in Nigeria, you can loan your crypto to someone in Hong Kong and earn interest over a fixed tenure. Some of the services that allow you to do this safely are Compound Finance, dy/dx and Dharma. BuyCoins also has a feature that allows you to lock stablecoins such as USDC (United States Dollar Coin) for interest. You can learn more about DeFi here.

How to avoid cryptocurrency scams

Just like with fiat currency, it is important to do your due diligence and understand how you’re earning the returns on any platform you choose to invest with.

To avoid getting scammed with cryptocurrencies: you should watch out for pyramid or Ponzi schemes and platforms that promise to give you very high returns on your cryptocurrency, and avoid trading or investing in random alternative coins, trading on random group chats, and buy, sell and securely store your crypto.

1. Run from pyramid or Ponzi schemes

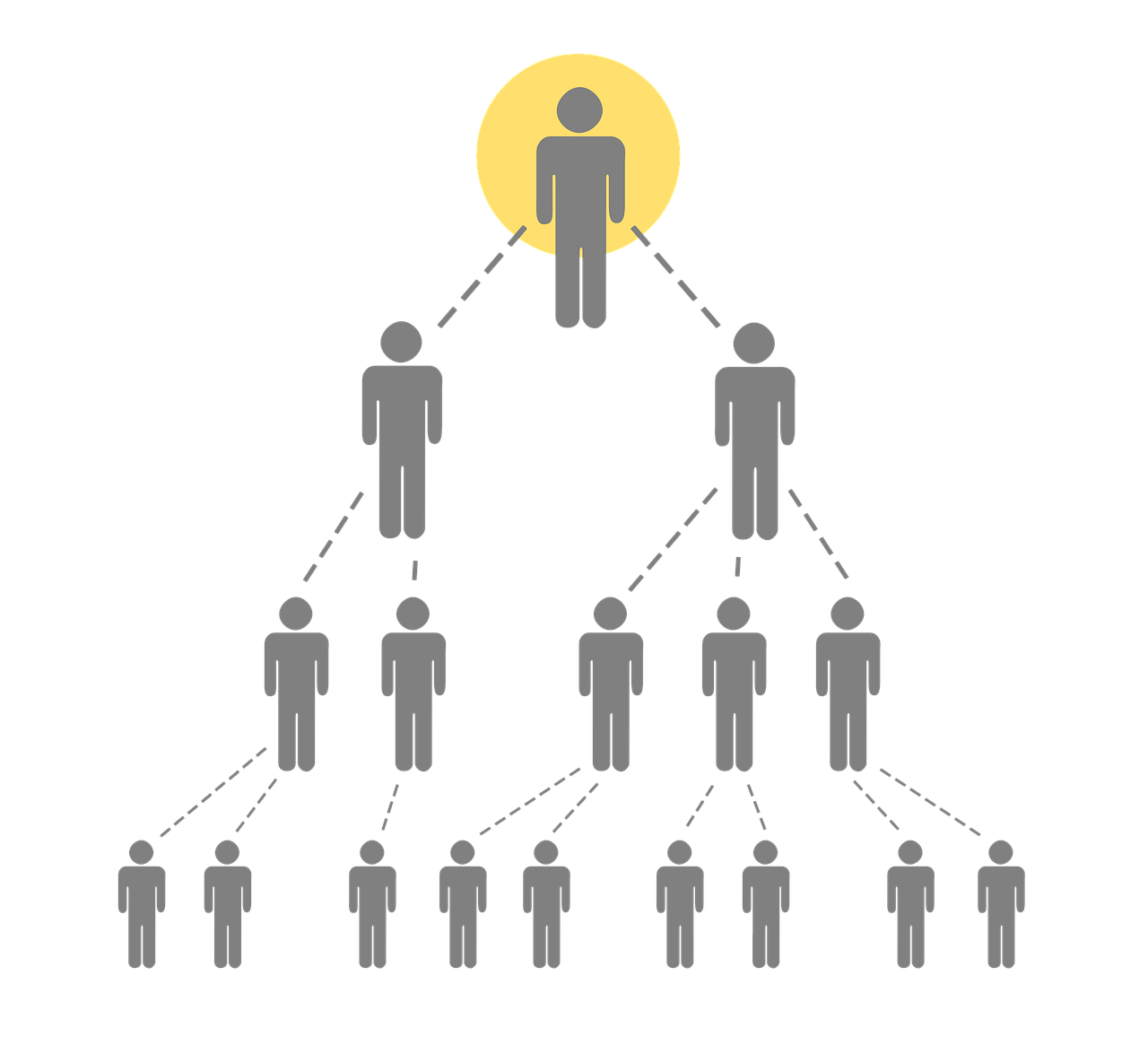

Much like fiat-based Ponzi schemes such as the infamous MMM, there are crypto-based pyramid schemes.

A pyramid scheme is a sham model where participants make money solely by recruiting others into the scheme, rather than supplying investments or sale of products. Early participants (AKA "investors") are paid from the contributions of new recruits, who then go on to recruit others.

Pyramid scheme is an unsustainable model. Because as soon as there are no new recruits to feed the system, the pyramid comes crashing down.

My principle with something like this is: "If it quacks like a Ponzi scheme and talks like a Ponzi scheme, it is very likely a Ponzi scheme". Run far away from any crypto investment opportunity that depends on your recruitment of other members to "invest" crypto to get returns.

2. Be wary of very high returns

As we've established, most cryptocurrencies are very volatile. This means that nobody can truly guarantee you very high returns or any returns at all. Professionals can postulate and predict, but if anybody tells you to send them Ethereum with the promise to triple it within a week, it is probably a scam and you should run as fast as your legs can carry you. (Ethereum is the second largest crypto behind Bitcoin.)

3. Buy, sell and securely store your cryptocurrencies

Ensure that you only buy and sell your cryptocurrency on reliable exchanges and platforms.

Information about the real-time price and value of Bitcoin is easily available online and it has now become very easy to buy and sell Bitcoin from Nigeria with services like BuyCoins and Binance. You can securely store your Bitcoin in non-custodial wallets such as Coinbase Wallet or a Trustwallet. A non-custodial wallet allows you to be entirely responsible for the security and management of your cryptocurrency.

Avoid trading on random group chats and allowing unvetted individuals to store your crypto. If you choose to trade on random Telegram or Whatsapp groups and allow unvetted individuals to store your Bitcoin for you, understand there are high risks. It is very possible you lose your Bitcoin. So, do your due diligence.

Just as you would not give a random Joe on a Telegram or WhatsApp group your hard-earned Naira or debit card information, be careful whom you authorize to transact your cryptocurrencies for you.

4. Don't invest in random altcoins

There are some legitimate altcoins: alternative cryptocurrencies that don’t have as much market volume or value as Bitcoin. But as a beginner, it’s best to stick to the more popular coins like Bitcoin, Ethereum, Litecoin and USDC.

You’re most likely not missing out on the financial opportunity of a lifetime by not putting your money in "Bluecoin" or whatever new coin someone pitches to you.

Again, remember that most of the same safety rules for fiat money apply to cryptocurrencies — plus extra caution. Do your research before trading on any exchange or asking anyone to do a trade for you.

Cryptocurrencies are neither a scam nor a "get rich quick scheme". They are, infact, a legitimate way for you to access financial opportunities from all over the world regardless of your location. However, when in doubt, you can lean on experts and resources such as:

- BuyCoins free “Introduction to Bitcoin” Course

- The Little Bitcoin Book,

- Bitcoin.org

- Decentralized Finance & Apps - A Primer

- Bitcoin Primer - ELI5

Written by Teju Adeyinka, Product Manager at BuyCoins. Editing by Tomiwa Lasebikan, Co-founder of BuyCoins.

Comments ()