Exclusive: Nigerian startup Cova shuts down

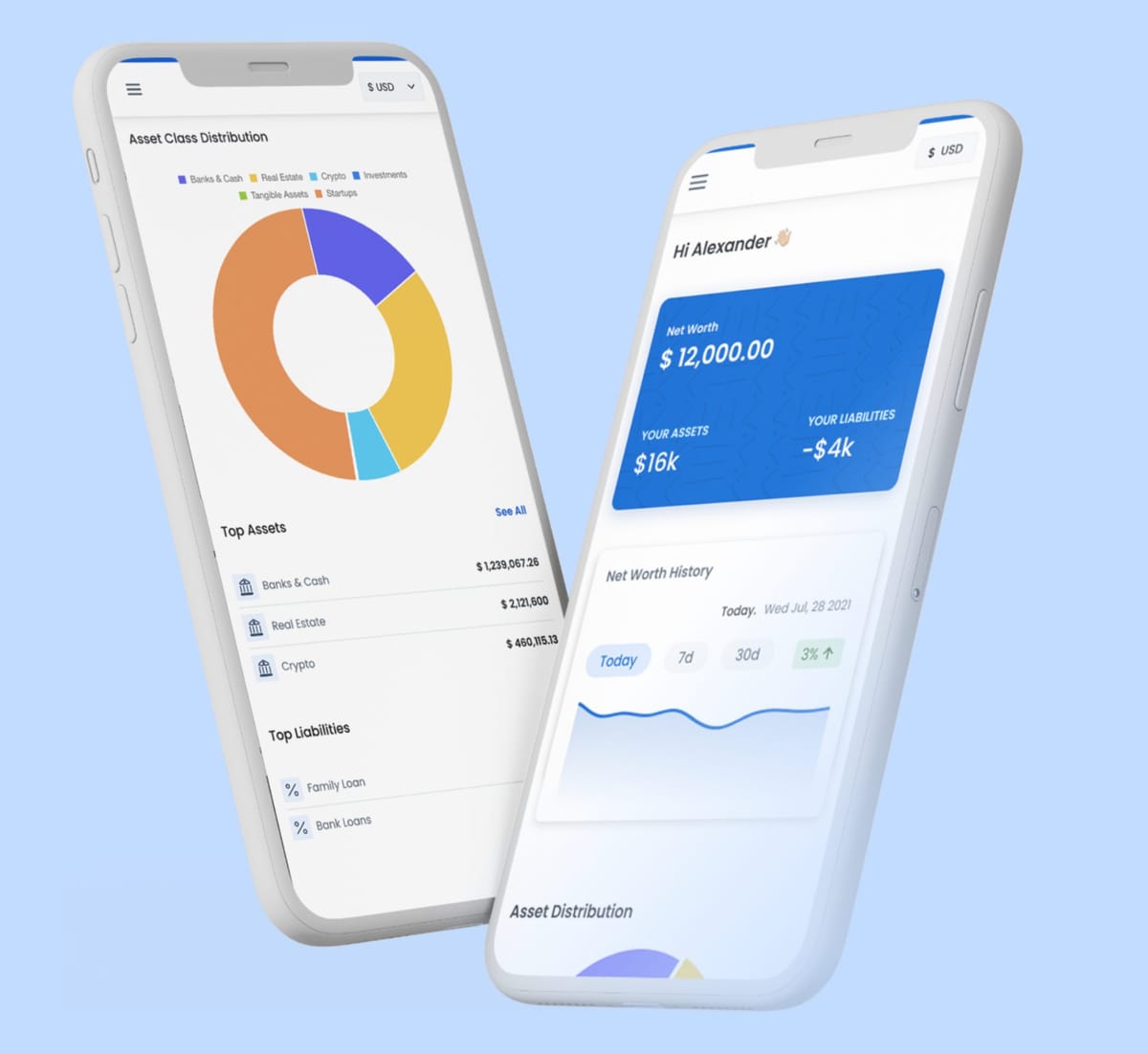

Cova, a Nigerian wealthtech startup that enables users to track their assets in one place, is shutting down.

Nigerian wealthtech startup; Cova co-founded by ex-CEO and founder at Printivo, Olu'yomi Ojo and Yomi Osamiluyi, is shutting down due to "several factors", the co-founders said in an email to users on Tuesday (January 23).

"This was an extremely difficult decision, one that was not made lightly," read the email. Cova will cease operations on Feb. 10, 2024. Meanwhile, subscription refunds will be made on or before Feb. 13.

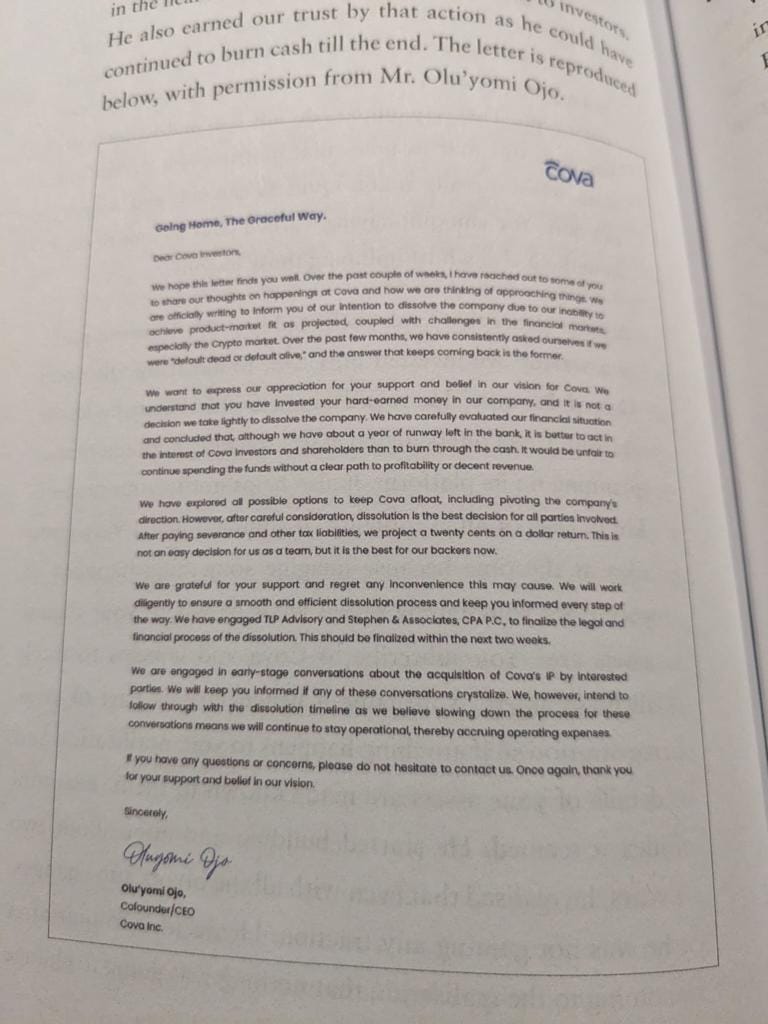

In his business memoir Vantage (launched in August 2023), Olumide Soyombo, one of Nigeria's leading angel investors, said that although Cova was providing an important solution, two years into its existence, the co-founders noticed that the product "was not gaining any traction".

Ojo, in an undated email to investors, as documented in Soyombo's memoir (Ref: Pages 248 & 249), stated, "We have carefully evaluated our financial situation and concluded that, although we have about a year of runway left in the bank, it is better to act in the interest of Cova investors and stakeholders than to burn through the cash. It would be unfair to continue spending the funds without a clear path to profitability or decent revenue."

Ojo and Osamiluyi co-founded Cova in December 2021 to serve as a "single source of truth" for every asset that its users own. Cova raised at least $800,000 from investors, including Soyombo. "[Cova] gives you the power to aggregate, manage and track everything, even while you’re alive, and also helps your people discover and claim your assets when you’re gone," says Ojo.

Until now, Cova offered subscriptions from $10 to $100 per month or year. Users could connect their Cova profile to local and international bank accounts, savings apps like Piggyvest and Cowrywise, investment platforms like Risevest and Bamboo, and crypto-wallets. The platform also enabled users to keep track of landed properties.

In 2022, Cova co-founder Ojo stated that its user base was in the "thousands" globally, but only those in Nigeria, the UK and the US could sync bank accounts.

Responding to some of the startup's challenges in its first year, Ojo said "Customers keep needing more. For instance, we have users already asking for deeper integration. They have multiple bank accounts in different countries, and they want to connect them to COVA." He also stated that trust has been a challenge: "What we do is still new, and people are not yet used to it. So they have many questions, and we have to earn their trust. We also have people who don’t want to think of death as an event to prepare for, especially in African countries."

While a few startups are now requiring next-of-kin details to ensure asset transfer after the death of the user, other African startups like Twinku are also providing an all-in-one asset management platform.

The story was updated to include findings from Vantage, a business memoir by Olumide Soyombo (Jan. 24, 2024. 14:29)

Comments ()