Chipper Cash raises $13.8 million Series A to hire 30 new staff in Lagos, London, Nairobi, New York and San Francisco

Chipper Cash, a mobile cross-border money transfer platform in Africa, has closed a $13.8 million Series A round to hire 30 new staff across its global operations.

Chipper Cash, a mobile cross-border money transfer platform in Africa, has closed a $13.8 million (₦5.3 billion) Series A round to hire 30 new staff across its global operations.

Ham Serunjogi (CEO)—a Ugandan—and Maijid Moujaled (President)—a Ghanaian—co-founded Chipper Cash in October 2018. Incorporated under Critical Ideas Inc, the San Francisco-based fintech has now raised a total of $22.2 million (₦8.6 billion) with this Series A.

In May 2019, Chipper Cash raised $2.4 million (₦930 million) in a seed round led by Deciens Capital. Seven months later, it received another $6 million (₦2.3 billion) funding in a seed round led by the same venture capital firm.

At the time (December 2019), Serunjogi, Co-founder and CEO of Chipper Cash, said, "We will use the capital to grow our team and move into new geographic areas. Southern Africa is an area we’re looking to expand to in 2020".

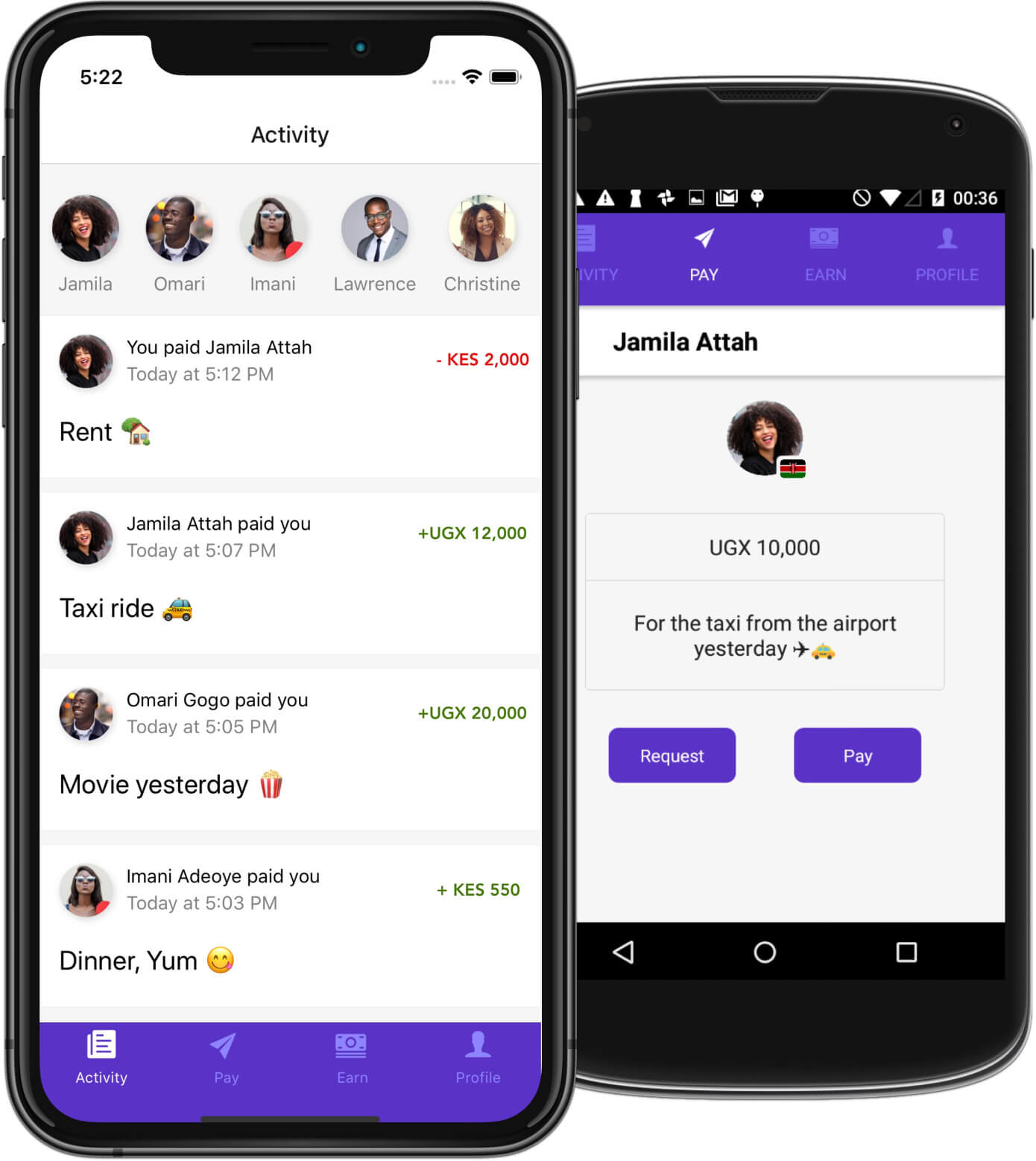

Chipper Cash, thus far, has launched in South Africa. Its mobile cross-border money transfer service is currently available in seven African countries: Kenya, Ghana, Nigeria, Rwanda, South Africa, Tanzania and Uganda. With Chipper Cash, anyone can send and receive money from and to these countries for free.

This latest round of funding will be used to hire 30 people to bolster Chipper Cash’s operations in San Francisco, Lagos, London, Nairobi and New York, TechCrunch reported.

Partnering with Paystack, Chipper Cash had launched in Nigeria in September 2019, and hired Abiodun Animashaun, co-founder of Gokada, as country manager. Alicia Levine, former Director of Business Transformation at BRCK, was also poached as the chief operating officer for Chipper Cash.

Very excited to announce that @chipper_cash is now available in Nigeria! Special thanks to @shollsman & the teams @paystack for the great collaboration on this. Also particularly thrilled to share that @alicialev is joining Chipper Cash as Chief Operating Officer!🇳🇬🎉🚀 https://t.co/4TlcGZTN3n

— Ham Serunjogi (@HSerunjogi) September 5, 2019

With a presence in the three biggest markets in Africa (Kenya, Nigeria and South Africa), Chipper Cash reports exponential user growth.

In May 2019, when it received its first seed fund, Chipper Cash said it had more than 70,000 active users and processed 250,000 transactions. In December 2019, after its second seed fund, Chipper Cash reported over 600,000 active users and more than 3 million transactions processed.

"We’re now at over one and a half million users and doing over a $100 million a month in volume", Serunjogi said.

Chipper Cash’s Series A was co-led by Deciens Capital and Raptor Group. 500 Startups and Liquid 2 Ventures, who participated in the first seed round, also reinvested in this funding round.

Thus far, One Way Ventures, Brue2 Ventures and Transition Level Investments have invested in Chipper Cash.

How does Chipper Cash make money, if it’s providing free cross-border money transfer?

In addition to raising its first seed round in May 2019, Chipper Cash also launched Chipper Checkout — a merchant-focused C2B mobile payments product.

Chipper Checkout is not free-to-use. Hence, revenues generated from Chipper Checkout and payment volume float are used to support its Chipper Cash’s free cross-border money transfers.

"When PayPal started, it was just a consumer to consumer free app", Sheel Mohnot, 500 Startups’ Fintech Partner, explained to TechCrunch at the time. "It is still free for consumer-to-consumer, but they monetized the merchant side. That model is tried and tested. It just doesn’t exist in Africa, so Chipper has the opportunity to do that".

However, it is pertinent to note that there are other players in the cross-border money transfer space in Africa. Notable among them are Bundle and Bitsika.

> [BuyCoins launches SendCash to enable users to credit their naira account with Bitcoin](/sendcash-transfer-money-nigeria/)Bundle is touted as a super app with digital wallet that supports crypto and cash. Users can buy, sell, and store digital currencies, such as Bitcoin, Ethereum and Binance Coin, as well as deposit and withdraw digital currencies and local fiat. Although it currently supports only Nigerian Naira, Bundle plans to support more than 30 African countries by the end of 2020.

Similarly, Bitsika allows users to spend money in Ghana and Nigeria, send money to other African countries, buy airtime, create and top-up virtual VISA cards and buy and sell cryptocurrencies such as Bitcoin, Binance USD and Africa Stable Coin (ABCD).

Serunjogi is however certain of Chipper Cash’s value proposition. "Our tech settle cross-border currency transactions in real-time, and that’s part of the value proposition of the platform", he said.

"By offering our product for free, we are not in a pricing war or competing on a dollar-to-dollar basis. We are quite comfortable with our position, and our long-term value proposition will speak for itself over time".

Comments ()