Bitcoin and the future of money in Nigeria

While Nigeria is still a long way from Bitcoin and cryptocurrency adoption at the grassroots, the future seems to be fast headed in that direction.

Bitcoin has always been hailed as a vital resource against suppression. This October, we saw it live up to its reputation.

As the Nigerian government allegedly clamped down on EndSARS protests with financial restrictions, cryptocurrency came to the rescue. As of the time of writing, the Feminist Coalition, which led fundraising for the protests, is only accepting donations in Bitcoin.

The success of Bitcoin in raising donations and its increasing usage in Nigeria, prompted me to consider the future of money in Nigeria and how bitcoin plays a role.

A brief history of money in Nigeria

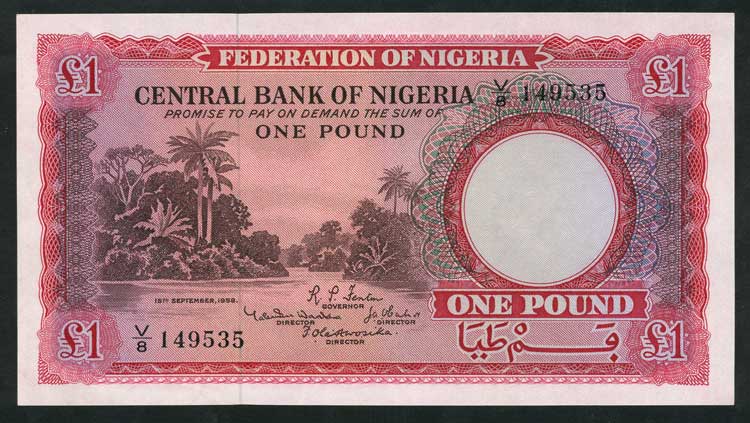

Nigeria's monetary history is a long one that predates its independence in 1960. The British colonial government, through the Bank of England, introduced the first formal currency in 1880. The Bank of England issued shillings and pence as the legal tender of the British West Africa (BWA) — a geographic region including all the colonies of Britain. The distribution of the currencies was handled by the Bank for British West Africa, a private institution, and predecessor of the First Bank of Nigeria.

It continued so until 1912 when the West African Currency Board (WACB) was created to look into currency issues in British West Africa. The WACB issued banknotes for Nigerian pounds and shillings as currency from 1912 until 1959.

In 1959, the Central Bank of Nigeria (CBN) took over from the WACB and continued issuing Nigerian Pounds until 1973.

To keep up with other economies, the Nigerian government led by General Yakubu Gowon in 1973 sought to decimalise its currency system. The result was the creation of the naira at a rate of 2 naira = 1 pound. The kobo, a minor currency, was created equivalent to the naira at a ratio of 100 kobo = 1 naira.

The naira's creation was greeted with aplomb since citizens regarded it as a symbol of national pride and nationhood. It highlighted a continued break away from the colonial overlords, and we finally had a currency in our image.

Since the introduction of the naira, the currency has undergone several evolutions with one constant - its production, distribution, and valuation of the naira have been determined by the CBN, and by extension, the Nigerian government. Most administrations have sought to uphold the pride of the hallowed naira.

Years of quirky fiscal and economic policies, however, left the naira weakened against other currencies - a reflection of the country's slow-growing economy. Expectedly, this has not gone down well with much of the population. The naira exchange rate against the pound now officially stands at around 500 naira to one pound, a 24,900% decrease in value from 1973.

One of such quirky policies is the arbitrary restriction on the transactional abilities of Nigerian bank account owners, especially domiciliary accounts. It has often been used to control foreign exchange (FX) rates, as uncontrolled spending may lead to more pressure against the naira.

Currently, the country has two currency exchange rates. The official currency exchange rate is managed by the CBN and tries to keep the value of the naira respectable. Most people, however, can only access forex at market prices, which are determined by demand and supply. The market prices range anywhere between 18% and 20% of the official CBN rate. The market price for the pound as of the time of writing is 592 naira, 18.4% higher than the official rate of 500 naira.

A changing demographic

Nigeria has one of the highest youth populations in the world. According to Index Mundi, 62.26% of the population is 24 years or younger.

Shaped by different circumstances than their predecessors, there’s a remarkable change in the younger generation’s approach to life. Internet-savvy, experimental, outspoken, and confident, many of these youngins actively seek self-expression instead of group (or national) glory. Less charitable observers may even refer to them as individualistic.

Today’s Nigerians have different financial challenges from their predecessors. The pride of the naira doesn’t mean a lot to them. Being able to earn a decent living and live a respectable quality of life is of more importance.

The explosion of the gig and remote-work economy has also coincided with their entrance into the labour market. For many young Nigerians, the dream is to get a remote job with a foreign company and earn globally competitive wages while in Nigeria.

Haunted by inflation

Inflation is like the poltergeist, no one sees it, but everyone knows it’s there, knocking things over and making a mess. Young Nigerians are learning the hard way that money is more than just a transactional tool; it is a store of value. They recognize that if the storage facility used is not reliable, that value will evaporate. The naira is very unstable and untrustworthy as a store of value.

Put in context, the naira has had at least 10% inflation for 14 out of the last 20 years. On average, the country has experienced over 12% inflation every year since the turn of the 21st century.

Table showing inflation rate since 2000

| Year | Inflation rate (%) | Annual change |

|---|---|---|

| 2019 | 11.40 | -0.70 |

| 2018 | 12.09 | -4.43 |

| 2017 | 16.52 | 0.85 |

| 2016 | 15.68 | 6.67 |

| 2015 | 9.01 | 0.95 |

| 2014 | 8.06 | -0.41 |

| 2013 | 8.48 | -3.47 |

| 2012 | 12.22 | 1.38 |

| 2011 | 10.84 | -2.88 |

| 2010 | 13.72 | 1.17 |

| 2009 | 12.56 | 0.97 |

| 2008 | 11.58 | 6.19 |

| 2007 | 5.39 | -2.84 |

| 2006 | 8.23 | -9.64 |

| 2005 | 17.86 | 2.87 |

| 2004 | 15.00 | 0.97 |

| 2003 | 14.03 | 1.16 |

| 2002 | 12.88 | -6.00 |

| 2001 | 18.87 | 11.94 |

| 2000 | 6.93 | 0.31 |

As of September 2020, inflation for the year stood at 13.71%. It is expected to climb even higher as the country struggles to recover from the economic impact of Covid-19.

How does Bitcoin fit?

The independent nature of young Nigerians is reflected in their distaste for control — either by friends, family, or the government. That nature was challenged when the government reportedly clamped down on bank accounts associated with the EndSARS protests.

For many people, including myself, it was a stark reminder that the government could clamp down on any individual or organisation, even if they had done nothing wrong.

Read: Donations for EndSARS protest move from fiat to Bitcoin

While Nigeria is still a long way from cryptocurrency adoption at the grassroots, the future seems to be fast headed in that direction. People are looking to separate their financial fortunes from government decision making. Whether it’s inflation or bank restrictions, people want to be able to protect themselves from the overarching, sometimes misguided, arms of government.

The Nigerian digital revolution

A peaceful physical revolution started with the EndSARS movement. Young people woke up to their power to demand better governance from those in power. A digital revolution is coming soon, and Bitcoin is going to be pivotal in it.

Indigenous crypto exchanges have made the process of buying Bitcoin easy for Nigerians. Quidax, one of the country’s leading cryptocurrency exchanges, has also developed an API that enables fintech companies offer cryptocurrency services to their customers without having to dedicate time and resources into building out these features. These exchanges also make it easy to convert your Bitcoin and other crypto into naira.

After serial issues with restrictions on Nigerian bank accounts, the Feminist Coalition continued fundraising in Bitcoin undisturbed. Apart from donating, Bitcoin can also be used in a number of ways:

- Transactions: Many Nigerians have already started using Bitcoin as their choice for making international transactions. Transactions are low-cost, and there are no border restrictions. As long as both parties have their crypto wallets, transactions can be carried out seamlessly.

- Value storage and investment vehicle: Hedging against inflation will also become more of a priority for young Nigerians as time goes on. Between January 2019 and the time of writing, the naira has experienced over 25% inflation. In that time, Bitcoin has appreciated by over 225%.

- Trading: Currencies have always been tradeable - that’s the entire point of the foreign exchange market. However, the chasm between the official and unofficial market rates has given an unfair advantage to those with influence in high places. With Bitcoin and cryptocurrencies, trading is a more level playing field.

How Bitcoin features in Nigeria’s monetary future

For the younger generation, Bitcoin is the currency in their image - digital, borderless, highly mobile, unrestricted, and decentralised. As witnessed in the EndSARS protests, decentralisation is a concept that the Nigerian youths apply to real life issues.

The protests were leaderless, much like Bitcoin has no governing body. It made the protests anti-fragile and difficult to hack by external forces.

While the naira will remain the country's official currency for the foreseeable future, many people will turn to Bitcoin as a second choice. As economic indices like inflation continue to go unaddressed, expect the adoption of cryptocurrency to keep rising.

Comments ()