BD Insider 154: Venture funding in Africa slowed down this month

In BD Insider, Letter 154, we take a deep dive into Nigeria's $618 million tech and creative fund, the state of venture capital on the continent and the latest about Emirates operations in Nigeria.

Over the weekend, Nigerians went to the polls to decide their state governors and legislators. The elections were met with voter suppression reports, leading to low voter turnout. At the time of writing this newsletter, the Independent National Electoral Commission (INEC) is counting the votes in some states, while others have been announced.

On the other hand, Nigeria's first "digital census", which was earlier scheduled for March 29, has been shifted to a yet-to-be-disclosed day in May.

Anyway, for Letter 119, we will examine the following:

- Nigeria's $618 million fund for tech and creative arts startups

- why Emirates has not resumed flight operations in Nigeria

As always, we share opportunities, noteworthy stories and more at the end of the letter. But first, let's examine the state of venture capital funding in the ecosystem.

💰 State of funding in Africa

Tech venture funding announcements have slowed in Africa, with early- and growth-stage funds retracting their steps due to the "tightening" economy.

This month, startups have announced a little over $33 million in venture capital funding. Compared to the first 20 days in February, where they raised half a billion dollars, this month's numbers are down by more than 90%.

"With the global economic slowdown trickling into 2023 due to inflationary pressures and tightening monetary policy, investors on the continent will maintain a judicious approach to investment, and African startups will continue to find fundraising challenging," Bruce Nsereko-Lule, a general partner at Seedstars Africa Ventures, said earlier this year.

Last week, South Africa's largest early-stage VC fund of approximately $77 million, Naspers Foundry Fund, discontinued its fund, citing tightened economic conditions.

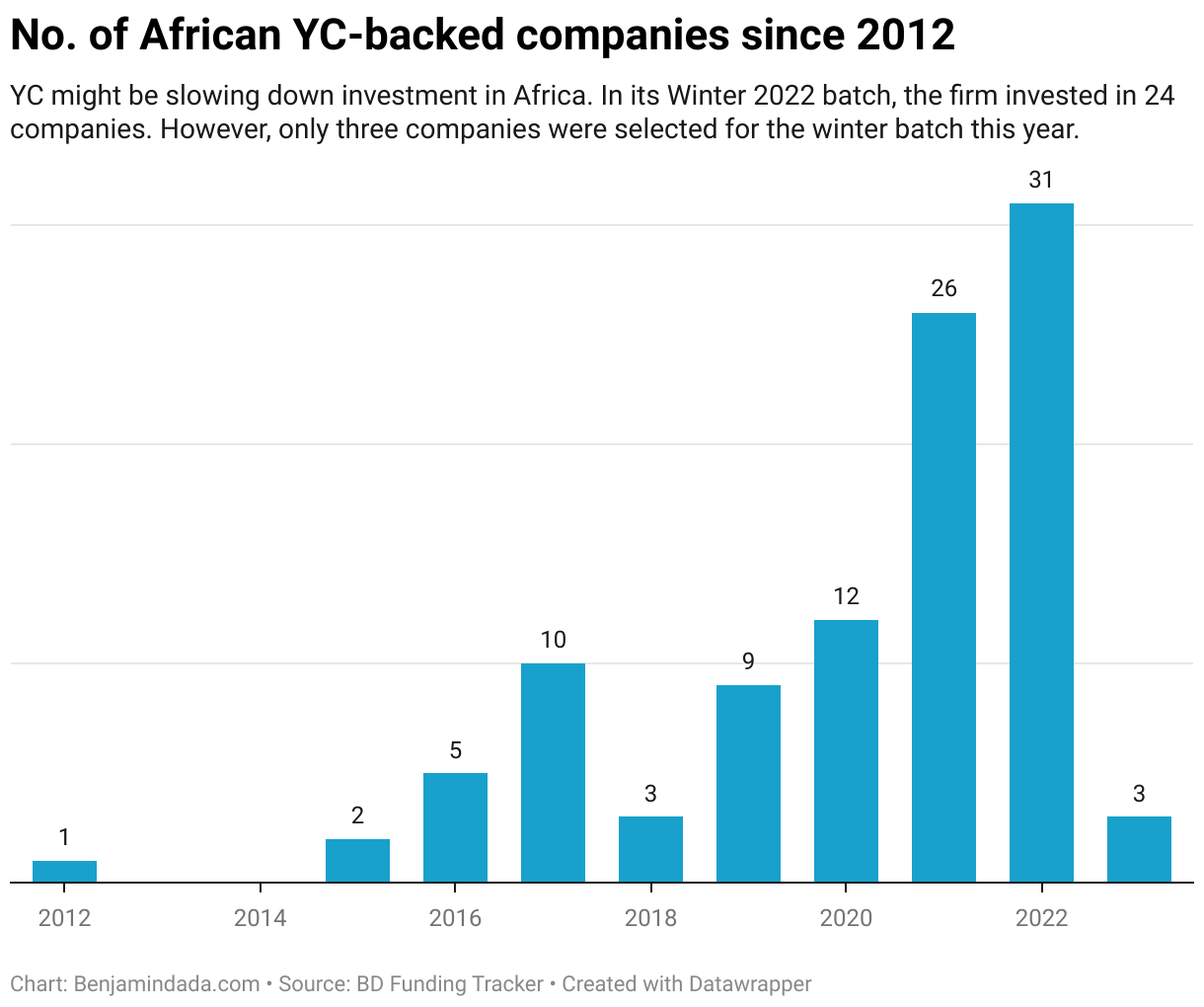

Similarly, Y Combinator (YC) also halted its $700 million Continuity Fund, launched in 2015, targeted at growth-stage startups. Garry Tan, YC's President, described the eight years old fund as a "distraction from [Y Combinator's] core mission...".

The closure of this fund might impact some of the over 100 YC-backed African startups that intend to secure follow-on investment through the fund. For instance, YC-backed 54gene, recently disclosed that it's looking to raise additional funding, it would have likely gotten follow-on funding from the fund since it's been one of the accelerator's top companies.

On the flip side, the Silicon Valley-based accelerator also accepted only three African companies in its winter batch this year, this is low compared to last year.

Meanwhile, between March 6-20, three multi-million dollar funds focused on West and East African startups have been launched by the Nigerian government and its partners, Echo VC and Flat6Labs.

Will this improve the funding on the continent?

Lesego Tladinyane, Investment Associate at Newtown Partners tells Benjamindada.com that “Africa will increasingly become a viable investment opportunity for more global funds.”

Let's watch out.

This week's stories

On Nigeria's $618 million fund for tech and creative startups

The news: The Nigerian government in collaboration with local and international partners has launched a $618 million fund to invest in the country's digital and creative industries.

The fund tagged Investment in Digital and Creative Enterprises Programme (iDICE) is backed by the African Development Bank (AfDB), the Agence Francaise de Development, the Islamic Development Bank and independent fund managers.

It will be managed by Nigeria's Bank of Industry. However, it is still unclear how startups can participate in the programme.

Why it matters: Yemi Osinbajo, Nigeria's vice president says the fund will bolster the growth of the multi-billion dollar tech ecosystem in the country as well as the creative industry. "The benefits of the program to Nigeria's economy are projected to be worth $6.4 billion," AfDB President, Akinwumi Adesina, added.

Zoom in: The iDICE fund will create 6.1 million direct and indirect jobs and equip more than 175,000 young people with technology and creative skills. About 451 technology startups, 226 creative enterprises and 75 enterprise support organisations will be supported by the fund, according to Adesina.

He further said that the iDICE model will be rolled out in other African countries through AfDB's Youth Entrepreneurship Investment Bank initiative, which will be designed to create a financial and non-financial services ecosystem to support startups run by young Africans and to create jobs.

ALX is showing you the way

In partnership with Mastercard Foundation, ALX Africa is offering scholarships in the following courses; salesforce administration, software engineering, data analytics, data science and AWS Cloud computing practitioner.

Guess what? Learning is a SPONSORED PLACEMENT💫

This is partner content.

Contact: hello[at]benjamindada[dot]com

Emirates flight operations in Nigeria are still suspended

The news: About five months later, Emirates Airline maintains that its flight operations in Nigeria are still suspended because a substantial balance of its revenue trapped in is yet to be repatriated.

In August, the Central Bank of Nigeria (CBN) released $265 million out of the total $464 million in trapped funds to foreign airlines. The UAE-based airline said only 50% of its fund has been released.

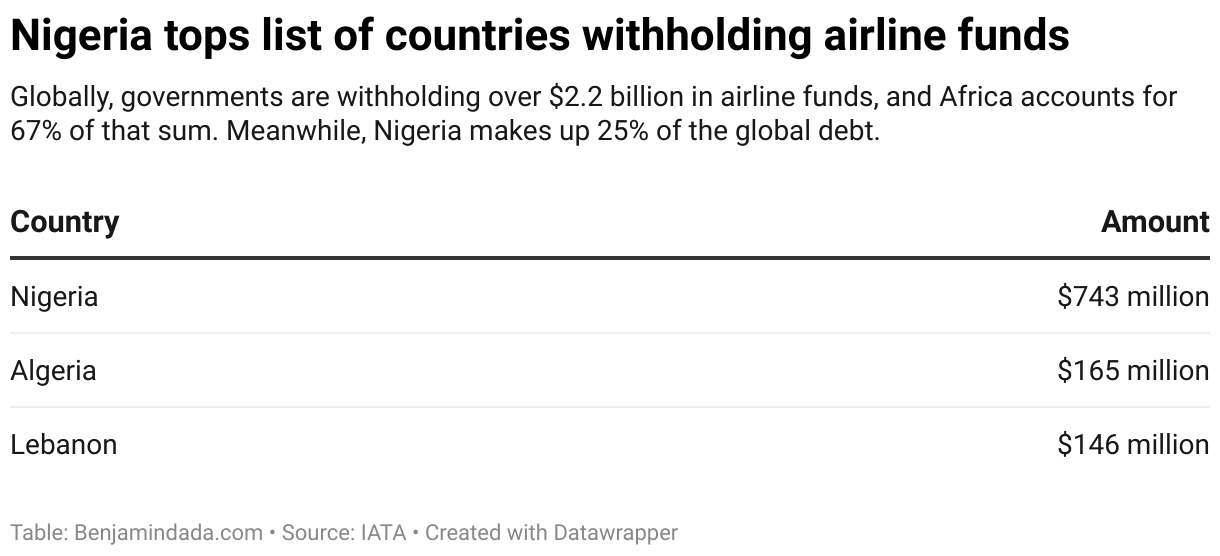

Foreign airlines trapped funds in Nigeria increased to $743 million in January, according to the International Air Transport Association (IATA).

Know more: Foreign firms—including airlines—that do business in Nigeria agree with the CBN to convert their naira proceeds to dollars at the official rate, as their costs are priced in dollars. However, oil revenue, Nigeria's primary FX source, has declined, and so has the amount of dollars available to the CBN to successfully defend the naira's peg to the greenback.

Zoom in: Last year, IATA said more airlines may suspend operations in Nigeria if the trapped funds are not released.

"Airlines can't be expected to fly if they can't realize revenue from ticket sales," IATA tweeted. "Loss of connectivity harms the economy, hurts investor confidence, and impacts jobs and people’s lives. The Government of Nigeria needs to prioritize the release of funds before more damage is done."

For the past year, Nigeria has topped the list of countries withholding airline funds globally, according to IATA. The association visited the country's aviation minister last week "to appeal for special intervention for the resolution of airlines' blocked funds' issue in Nigeria".

Zoom out: According to IATA Area Manager for West and Central Africa, Samson Fatokun, Nigeria is going against its obligations as signed in the Bilateral Air Service Agreement (BASA).

However, local airline operators in Nigeria also argue that the aforementioned demands are not legitimate. "There is a need for fairness and equity, the BASA as it is operated now is skewed to favour the foreign airline operators more than [local operators]," Amos Akpan, the Managing Director of Flights and Logistics Solution, said. "You have a system where Emirates is operating 21 flights in Nigeria, and it took a lot of rancour for Air Peace to be given three slots in Dubai a week."

Get an instant fully functional USD virtual bank account within minutes

Easily create a USD virtual bank account to receive foreign payments for your work. Geegpay by Raenest provides Instant account verification, a Wells Fargo USD virtual bank account that supports ACH & local wire transfers, the best exchange rates, and the fastest bank payouts.

This is partner content

📚 Noteworthy

Here are other important stories in the media:

- Inside Flowmono’s effort to accelerate Africa’s remote work model: Dara reports on how Flowmono is helping freelancers, small businesses and major corporations transition to remote work by creating e-signing and business process management tools.

- FairMoney acquires PayForce: Retail-led microfinance bank, FairMoney expands merchant offerings by acquiring PayForce, a sub-brand of YC-backed CrowdForce.

- A list of the harmonised USSD codes in Nigeria: Effective May 17, 2023, all mobile operators are mandated by the Nigerian Communications Commission to migrate from diverse shortcodes to harmonised codes.

- Why Nigerians will be charged a NIN verification fee for passport application: The National Identity Management Commission says Nigerian citizens resident in the country will be charged a ₦1000 fee for NIN verification for each Nigerian passport application.

💼 Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Olly Olly — UX/UI Designer, Nigeria

- M-KOPA — Senior Product Manager, Ghana

- Kuda — Lead Product Manager and other product roles

Data & Engineering

- FiClub — Backend Engineer, Ghana

- Kuda — Frontend Engineer, Nigeria

- Andela — Engineering Matching Specialist

Admin & Growth

- TikTok — Content Partnership Manager, Nigeria

- Lemonade Finance — Social Media Associate, Ghana

- Assets MFB — Head of Brands and Marketing, Nigeria

Other opportunities

- For African founders: Techstars Toronto is receiving applications, interested founders can apply on or before April 5, 2023.

- For African founders: After investing over $7 million into 110 African startups within two years, Google through the Black Founders Fund wants to invest in more startups on the continent. Deadline: March 26, 2023

- Entrepreneurs in Kenya, Uganda, Ethiopia, Zambia and Ghana: Applications for the 2023 cohort of the GrowthAfrica Accelerator are ongoing, and businesses in the aforementioned countries with a turnover of over $50K are eligible to apply.

- For African edtech entrepreneurs: CcHub and Mastercard Foundation are partnering to empower edtech startups who are building tools that enhance learning outcomes and accelerate access to equitable and quality education for Africa's next generation. Application Deadline: March 17, 2023

Have a great week ahead!

Comments ()