BD Insider, Letter 151: Poor tech marred Nigeria's election

In BD Insider, 151, we examined the Nigerian elections, Netflix's price reduction in sub-Saharan Africa, why BNPL startup Tabby is suspending operations in Egypt.

The election of who would become Nigeria's next president occurred on Saturday, February 25, 2022. The election results are still being compiled. Nigeria has suffered from three pandemics: fake news, violence at polling units and sloppiness from the electoral commission, INEC.

As the country awaits election results, we curated some platforms where you can monitor its progress.

In letter 151, we examine the following:

- Netflix's price reduction in sub-Saharan Africa

- why BNPL startup Tabby is suspending operations in Egypt

- Zambia's stance on cryptocurrency

and other noteworthy information like:

- the latest African tech startup deal

- opportunities, interesting reads and more

The big three

Netflix reduces subscription costs in sub-Saharan Africa

The news: Global streaming platform Netflix has reduced the cost of its service in some sub-Saharan African countries, according to the Wall Street Journal, which first reported the news.

"We are always exploring ways to improve our members' experience. We can confirm that we are updating the pricing of our plans in certain countries,” a spokesperson for the company said. However, he did not give further details about the price cuts.

Why it matters: According to Dataxis, Showmax and Netflix are the dominant players in sub-Saharan Africa's on-demand video market, with a market share of 31.6% and 29.7% of subscribers, respectively.

However, the high cost of internet access and subscription fees has affected the rapid adoption of these platforms in the region. Oftentimes, when originals are released on these platforms, most individuals depend on sites that provide pirated copies for free.

Earlier this year, the company disclosed its plan to crack down on password sharing, another activity affecting its revenue growth.

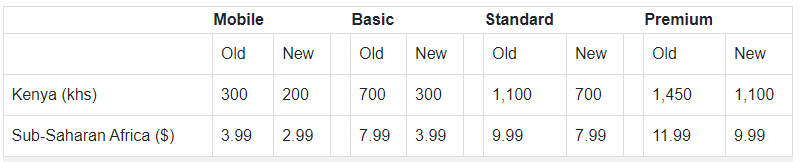

Zoom in: Based on data shared by TechWeez, Netflix applied the price cost across all its pricing options; mobile, basic, standard and premium.

The MENA-based startup Tabby suspends operations in Egypt

The news: Barely six months after expanding into Egypt, MENA-based buy now, pay later (BNPL) startup Tabby will shut down its operations in the North African country effective March 23.

"In a short period of time, we have seen very strong adoption of our products and services with some great merchant partners," Tabby CEO and co-founder Hosam Arab said. "However...we have decided to pause our commercial operations in the Egyptian market."

Arab says this decision will enable the company to focus on its major markets—Saudi Arabia, UAE and Kuwait. There will be no layoffs, and Tabby will continue to invest in growing its team on the ground, which will refocus on supporting its core markets, Arab told The National.

Shortly after securing a $58 million investment at a $660 million valuation last month, CEO Arab described the Egyptian market as a "fairly difficult spot at the moment with a constant devaluation of their currency".

Perspectives: According to Ahmed Khaled, a MENA-based tech entrepreneur, "it makes so much sense that Tabby would exit the market in Egypt, not only because of the macroeconomic reasons...but because it was too easy to purchase without any kind of checking on the credit score or checking any history of debt because, in Egypt, the credit score and debt history isn't connected directly to your National ID for example like other countries".

Meanwhile, another regional entrepreneur, Mohamed Shaheen, said, "the Egyptian BNPL market is already fully covered by local vendors". Currently, Blnk, Sympl, valU and Khazna are some of the BNPL providers in the country.

However, high inflation is also driving the popularity of the BNPL payment option globally, with consumers taking advantage of short-term financing to split payments and better manage their money.

Zoom in: BNPL payment adoption in Egypt is expected to record a compound annual growth rate of 55.9% between 2022 and 2028, while gross merchandise value is estimated to reach $6.23 billion by 2028, from $186.7m in 2021, according to a report published by Research and Markets.

Zambia wants to regulate cryptocurrency

The news: Zambian authorities, through the Security Exchange Commission and Bank of Zambia (BOZ), is testing technology to enable regulation of cryptocurrency in the country. According to technology and science minister Felix Mutati, "cryptocurrency is the future the country desires to achieve; there is a need for a policy framework that supports this revolutionary technology".

Why it matters: Last year, several African countries, including Nigeria, updated their stance on cryptocurrencies. In November 2022, the International Monetary Fund pushed for increased regulation of Africa's crypto markets as the region’s crypto industry grew. Among the reasons for embracing regulation, the monetary fund cited the collapse of FTX and its ripple effect in cryptocurrency prices and the operations of some Africa-based web3 and crypto startups.

According to IMF’s data, 25% of countries in sub-Saharan Africa have formally regulated crypto, while two-thirds have implemented some restrictions.

Zoom out: The Central African Republic is the first country in Africa and the second in the world after El Salvador to designate Bitcoin as a legal tender.

A move has put the country at odds with the Bank of Central African States (BEAC), the regional central bank that serves the Economic and Monetary Community of Central Africa (CEMAC), which the Central African Republic is a member of—and violates the CEMAC Treaty.

BEAC's banking sector supervisory body—Central Africa's Banking Commission—has banned using crypto for financial transactions in the CEMAC region.

💰 State of funding in Africa

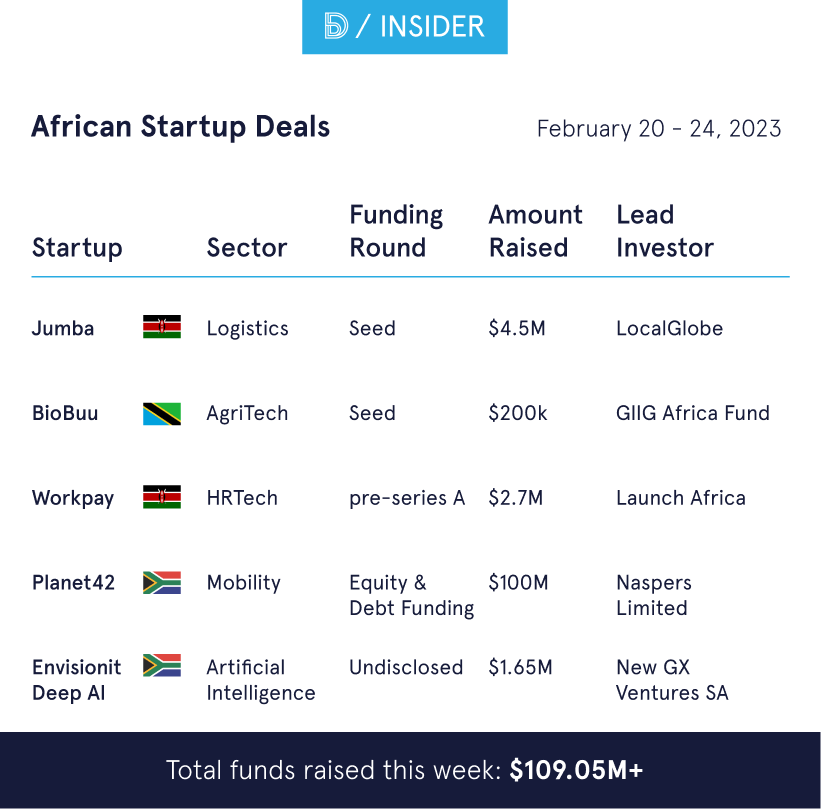

Over $109 million was jointly raised by five African startups last week.

South African mobility startup, Planet42's $100 million investment was the highest amount raised in the week under review. The fund comprises $15 million of equity from new and existing shareholders, including Naspers Limited, Andrew Rolfe, Change Ventures, $10 million of debt from shareholders, and a $75 million credit facility from Rivonia Road Capital.

We have carefully curated other deals closed last week in the table below. Also, visit BD Funding Tracker for more insights.

📚 Noteworthy

Here are other important stories in the media:

- The Investors' Corner — Peter Oriaifo, Principal at Oui Capital: Peter Oriaifo, principal at Oui Capital, talks about his venture capitalist career and outlook on the African tech ecosystem.

- Network freeze is not a network shutdown or outage: MTN Nigeria has announced a network freeze during the forthcoming general elections in the country; this is not a network shutdown or outage. What is it?

- Bolt lay off 24% of its workforce: To improve its operational processes in Nigeria, it has laid off 24% of its workforce there. The company is currently looking for a country manager.

- How do these African founders hire and manage talents?: Eight founders of multi-million dollar African tech companies talk about how they hire and manage their workforce.

- The most powerful African passports in 2023: Based on easy access to different locations without hassle, the Henley Passport Index has ranked these African passports as top ten in 2023.

💼 Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Brass — Brand Designer & Product Designer, Lagos

- Vendease — Technical Product Manager, Lagos

- Bamboo — Product Manager, Remote

Data & Engineering

- Nomba — Backend Engineer & Frontend Engineer

- Flutterwave — Software Developer, Nigeria

- MTN — Machine Learning Analyst

Admin & Growth

- Bolt — Country Manager, Lagos

- Payday — CFO & Finance Lead, Remote

- Flutterwave — Internal Comms Lead, Lagos

Other opportunities

For Nigerian media entrepreneurs: Applications are now open for the Sustainability Challenge for Nigerian media. Winners will be awarded up to $50,000 for their project and join NAMIP’s innovation and capacity-building program extending to 2024.

Have a great week ahead!

Comments ()