BD Insider, Letter 147

In BD Insider, Letter 147, we examine licensed digital lenders in Nigeria, the amendment in Kenya's employment bill and the Nigerian trade union of Bolt, Uber and e-hailing drivers.

Each of the selected startups will receive a $120,000 investment, as well as curated startup programming and access to Techstars' vast network of 7,000+ mentors, 20,000+ investors, alumni, and corporate partners.

Today, we examine:

- licensed digital lenders in Nigeria

- the amendment in Kenya's employment bill

- the Nigerian trade union of Bolt, Uber and e-hailing drivers

and other noteworthy information like:

- the latest African tech startup deal

- the Insider's Perspective with ARM Labs Techstars MD

- opportunities, interesting reads and more

💬 The Insider's perspective

How can African founders survive the global economic downturn?

Oyin Solebo, the Managing Director of ARM Labs Techstars Accelerator, shares four things founders should pay attention to during the economic downturn.

Also, getting advice from other entrepreneurs who have built similar businesses before is also important, which is why the roles of accelerators like Techstars—who have a large network of mentors—are significant in the ecosystem.

Founders should keep to their business lanes and they should make smart decisions about who they are hiring and when they're hiring them.

Lastly, founders should take advantage of the downturn by engaging great talents that have been laid off from bigger organisations.

The big three!

Pivo Africa, Payhippo, Fairmoney and 103 others licensed as digital lenders in Nigeria

The news: The Federal Competition and Consumer Protection Commission (FCCPC) has approved the operation of 106 companies as licensed digital credit providers in Nigeria. Out of the 106, 65 received full approval, while the other 41 were given conditional approval.

According to the FCCPC, all licensed providers must comply with the provisions of the Federal Competition and Consumer Protection Act, 2018; and the Nigeria Data Protection Regulations, 2019. As well as the CBN guidelines on anti-money laundering and combating the financing of terrorism.

Why it matters: Predatory lending in Nigeria has been on the increase, especially after the COVID-19 pandemic where several people lost their jobs and businesses.

With its rise, FCCPC has continued to crack down on unethical credit providers. Last August, the commission ordered Nigerian fintechs to stop providing payment or transaction services to digital money lenders under its investigation. In March 2022, FCCPC closed down and froze the ban accounts of six other predatory loan operators—GoCash, Okash, EasyCredit, Kashkash, Speedy Choice and Easy Moni.

Following the implementation of the interim guidelines for digital lending in the country, Google asked loan apps operating in Nigeria to provide their operating licence or they will be removed from Google Playstore.

Zoom in: According to the CBN, institutions with a microfinance bank (MfB) licence are allowed to provide credit to their customers. However, some digital banks— operating with the CBN MfB licence—were captured on the FCCPC list.

The FCCPC is yet to respond to our request for comments on this issue.

The fastest cross-border payments tool for freelancers & remote workers

Are you a freelancer or remote worker earning in USD, GBP & EURO? Get paid through Native Teams and withdraw directly to your Naira account.

With Native Teams, you get;

- International payments in any currency

- Withdrawal at parallel market rates to your local bank account

- Virtual and physical USD Card

Start receiving money from your clients and employers with the free plan on Native Teams. Invoice your employers, receive payments and send to your local bank all for free with Native Teams.

Contact: [email protected]

New bill wants to give Kenya residents "right to disconnect" after work

The news: A proposed amendment of the Kenya Employment Bill sponsored by Nandi Senator, Samson Cherarkey intends to block employers from interfering with the work-life balance of their employees via calls, text messages, emails, or assignments past working hours, weekends and public holidays.

Why it matters: According to Senator Cherarkey, "this Bill seeks to address increased employee burnout. Digital connectivity has also been noted to be slowly eroding leisure time for employees hence affecting their work-life balance."

If the Bill is passed into law, employers who breach the provisions will be fined $4,000. Also, institutions with over 10 employees shall be required to consult their employees or trade unions when formulating their out-of-work policies.

The modalities for reporting the breach are yet to be disclosed.

Counterposition: "The engagement between employer and employee during out-of-work hours is a management issue and should not be legislated," the Federation of Kenya Employers (FKE) stated. "If passed, [the Bill] will create two centres of managerial power and cause disharmony and indiscipline in workplaces."

FKE also accused the Senate of seeking to micromanage private institutions in the country. "FKE does not agree with the proposed amendments because they not only present radical changes to the Employment Act 2007 but also introduce new stringent measures that will curtail the prerogative to manage enterprises by the owners. This will automatically pose a challenge to industrial relations in Kenya," FKE Executive Director, Jacqueline Mugo was cited by the Nation Africa.

Zoom out: With more people working from home, especially in the post-COVID-19 pandemic era, countries like France, Italy Belgium, Ireland and Portugal have implemented legislation on the "right to disconnect".

A European-wide version of this regulation was proposed in January 2021.

📊 Africa in numbers

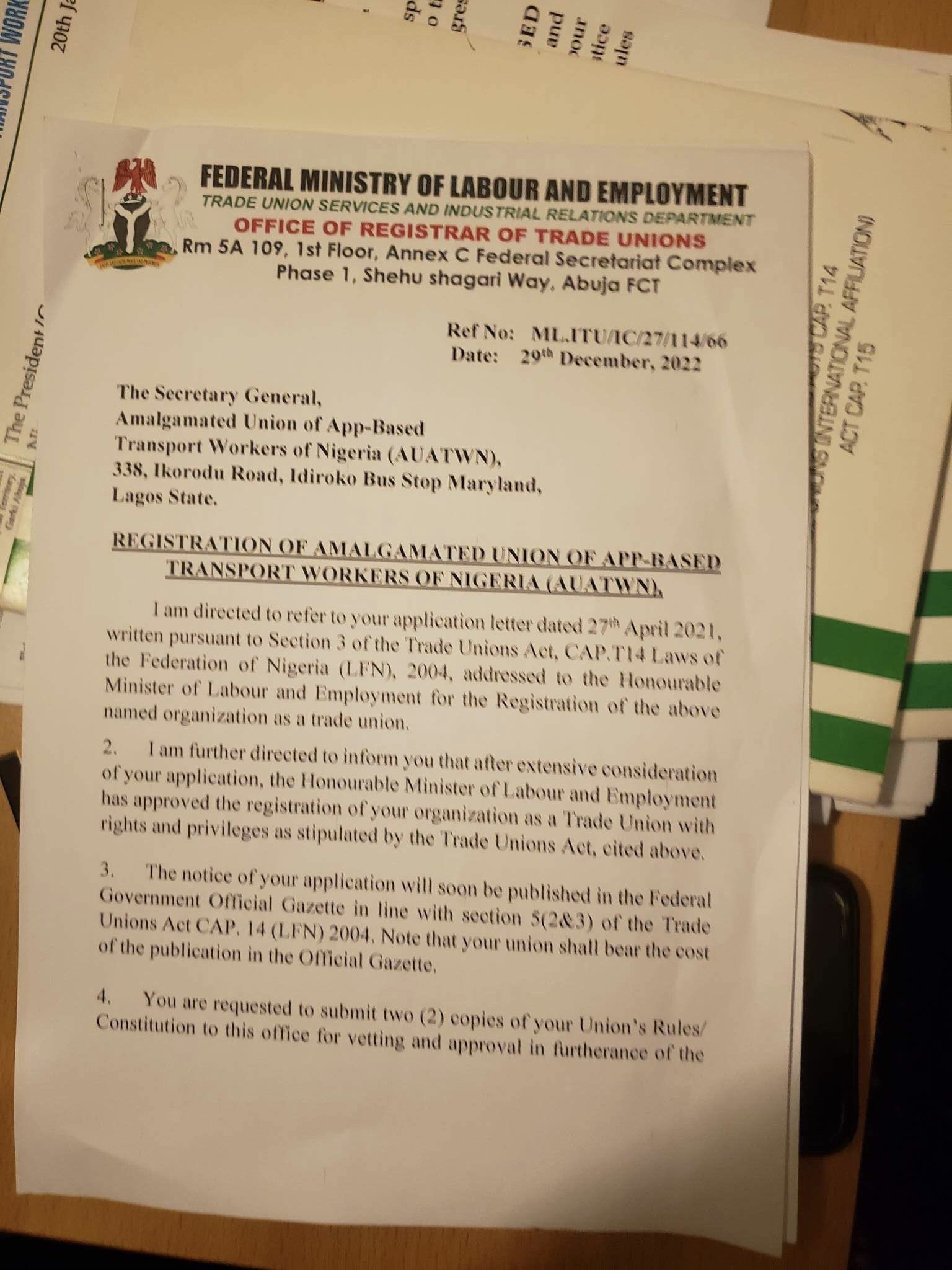

Nigerian government approves trade union of e-hailing app drivers

The news: Amalgamated Union of App-Based Transport Workers of Nigeria (AUATWN), a coalition of drivers at Bolt, Uber and other ride-hailing companies has been approved by the country's labour ministry.

This is coming over a year after AUATWN applied for registration as a trade union. "I am directed to inform you that after extensive consideration of your application, the Honourable Minister of Labour and Employment has approved the registration of your organization as a Trade Union with rights and privileges as stipulated by the Trade Unions Act," a letter obtained by Benjamindada.com reads.

Why it matters: "Since we do not have a recognised union, it is difficult to air our grievances. Bolt is not on the ground so they do not understand our plights," an anonymous Jos-based Bolt driver told Benjamindada.com in November 2022 during a warning strike by Bolt drivers in the Northern Nigeria city to protest low charges and increased discount for passengers despite fuel scarcity.

"We operate in the informal sector of the economy therefore we need protection from app-based companies. They use our expertise to make money for themselves without consulting us during important decision makings. With a government-approved union like AUATWN, all that will stop. We can now negotiate with them to recognize what we are passing through when we carry out our duties," Ibrahim Ayoade, AUATWN general secretary, said.

Zoom in: According to Ayoade, "our focus is on the welfare, liberation, and collective bargaining initiatives of app-based transport workers in Nigeria and Africa. We will also focus on creating strong partnerships with governments, ride-hailing companies and any other relevant stakeholders in our industries."

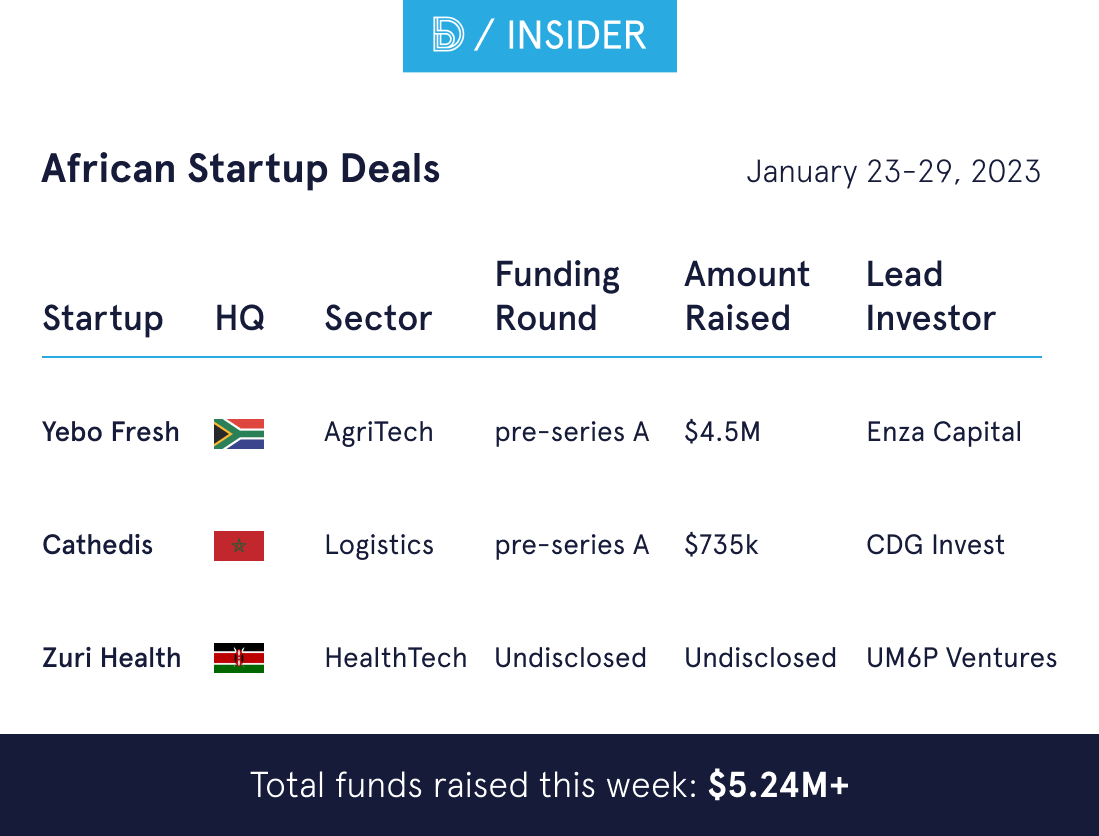

💰 State of funding in Africa

African startups have jointly raised over $68 million in January 2023. Nigeria, South Africa, Kenya and Egypt still remain the favourite investment destination. AgriTech startups accounted for 29.2% of these deals, according to BD Funding Tracker. Followed by CleanTech and FinTech.

Find details about last week's deals in the table below.

📚 Noteworthy

Here are other important stories in the media:

- National IDs are important for KYCs but they suffer downtimes in Africa: In 2022, National ID databases in Africa experienced an average daily downtime of 6%, according to Smile Identity's KYC report. This frequent downtime hinders their reliability as a sole verification step in onboarding customers on the continent.

- Understanding the technologies that will power Nigeria’s 2023 general elections: Paul James, Head of Elections Projects at Yiaga Africa provides insights into the key technologies; BVAS and IReV—that will enable Nigerians to decide their next political leaders come Feb. 2023.

- Kenyan court rules in favour of M-Pesa to Bank transfer charges: Safaricom and Kenyan banks have been allowed to charge for M-Pesa to bank transactions, according to a new court order.

- What you need to know about advertising crypto in South Africa: SA Advertising Regulatory Board has included a new clause for the cryptocurrency industry aimed at protecting consumers from unethical advertising.

- How to utilise media buying and advertising to increase lead generation: David Akinfenwa, Biz Dev and Partnership Lead at Benjamindada.com write on how media buying and advertising can be utilised to increase lead generation for individuals and organisations.

- Tech Nation shutting down as UK government controversially pulls key funding: Tech Nation, the UK startup organisation that helped bring thousands of talented tech workers to the UK, has announced that it will cease operations in March after the UK government pulled key funding.

💼 Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Okra — Product Manager

- TM Labs — Product Designer

- Reliance Health — User Experience Researcher

Data & Engineering

- Moniepoint — Senior Backend Engineer (Java)

- Lazerpay — Senior Backend Engineer

- Seamfix — Software Engineering Manager

Admin & Growth

- Glovo — Growth Analyst

- Jobberman — Head of Digital

- Pulse — Social Media Manager

- Sun King — VP Public Policy and Govt Relations

Other opportunities

- For African entrepreneurs: The Tony Elumelu Foundation is currently receiving applications for its 2023 entrepreneurship programme; a 12 weeks training programme with a $5000 non-refundable seed. Deadline: March 31, 2023

- For data enumerators: Stears is hiring Data Entry Contractors to support its work on Nigeria’s 2023 elections.

Comments ()