BD Insider, Letter 134

In BD Insider, Letter 134, we examine Nigeria's plan to auction two additional 5G licenses, South Africa's crypto stance and why Wise is halting dollar transfers to Nigeria.

Last week, the United Arab Emirates (UAE) imposed an immediate visa ban on Nigerian nationals. The UAE did not disclose the reason for the ban. Prior to this complete ban, the UAE had attempted to restrict the flow of Nigerians into its country. They put forward a visa policy that denies Nigerians under the age of 40 tourist visas. The only caveat to that policy was for those applying for family visas.

This is a sad development and could impact Nigerian tech workers who are looking to emigrate to Dubai to benefit from its tax-free regime. Also, it could hinder and force big techs like Amazon, who want to hire for the EMEA region but situate their staff in Dubai, to rethink their strategy.

Anyway, we expect the Nigerian foreign affairs ministry to look into this.

MTN Nigeria has also disclosed its plan to invest $150K into 100 Nigerian SMEs through its Blow My Hustle initiative.

For Letter #134, we examine:

- Nigeria's plan to auction two additional 5G licenses for $547.2 million

- South Africa's latest and conflating crypto stance

- why Wise (formerly, TransferWise) is halting dollar transfers to Nigeria

and other noteworthy information like:

- the latest African Tech Startup Deals

- BD Trivia: The odd one!

- opportunities, interesting reads and more

The Big Three!

1. Nigeria's telco regulator to auction two additional 5G licenses for $547.2 million

The News: The Nigerian Communications Commission (NCC) has disclosed that it is auctioning the remaining lots of 2 x 100MHz in the 3.5GHz spectrum band to support 5G deployment in Nigeria.

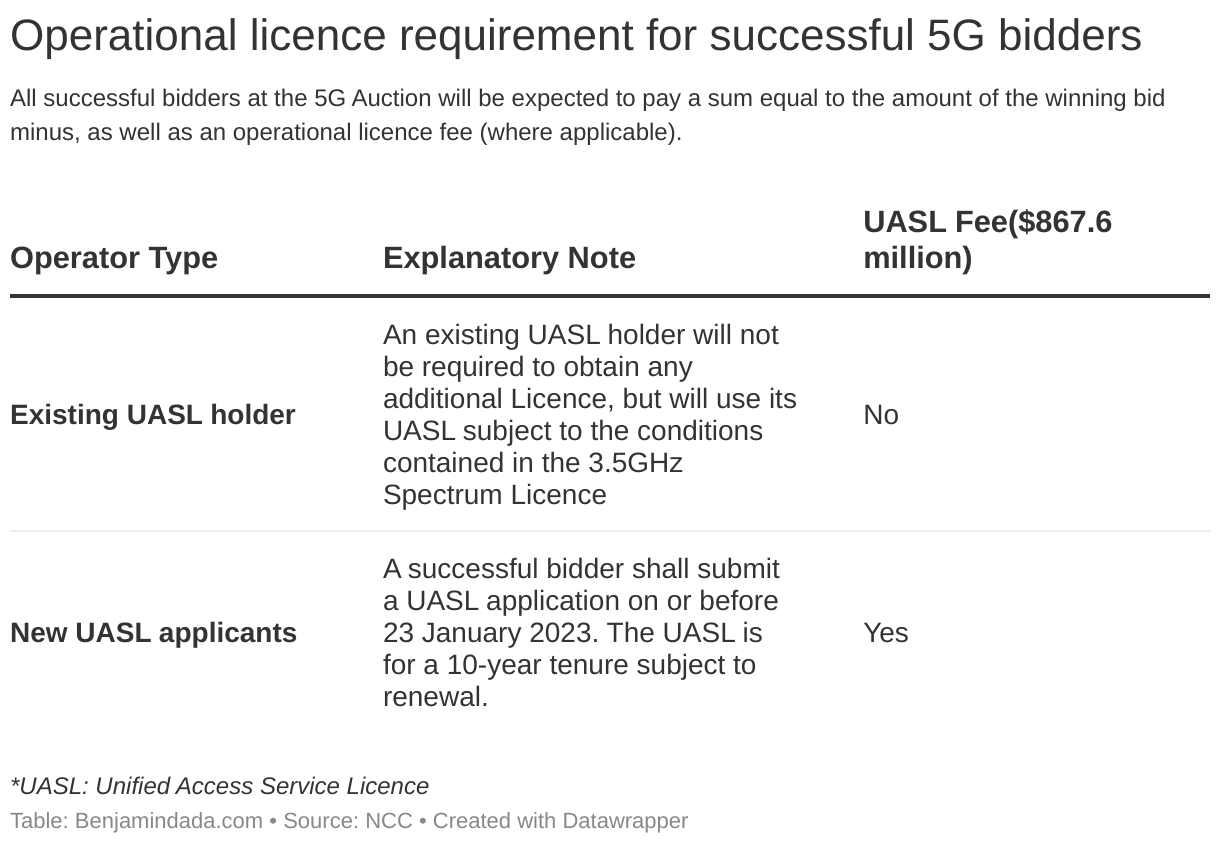

How it will work: According to an NCC Information Memorandum, the reserve price for the 10-year licence tenure is $273.6 million per slot. Applicants for the spectrum do not have to be licensed network operators in the country. Yet, they will need a unified access service licence (UASL) on or before January 23, 2023, if their bid is successful.

Reuben Muoka, NCC's Director of Public Affairs disclosed that the commission will hold a public consultation regarding this latest development on November 15, 2022.

Zoom out: Recall that, in February 2022, MTN Nigeria and Mafab Communications Limited made their full payment of $273.6 million each for a 5G spectrum licence after emerging winners of the 3. 5 GHz spectrum auction.

Although MTN has rolled out the 5G mobile network, Mafab suspended roll-out till December 2022, due to delays in receiving its UASL.

At the moment, less than 1% of mobile phone connections in Sub-Saharan Africa are on 5G. This number is not expected to grow this year but is likely to reach 7% in 2026, per a report by Ericsson, a Swedish networking and telecommunications company that partnered with MTN Nigeria for its 5G trial in 2019.

Earn up to $3K for consuming APIs

Connect with top global businesses by assisting them in integrating Fincra's APIs, and earn money while at it! Ready to make some extra money doing what you enjoy?

2. South Africa now recognises crypto assets as financial products, but not as legal tender

The News: Starting October 19, 2022, South Africa's Financial Sector Conduct Authority (FSCA) declared crypto assets as financial products under the Financial Advisory and Intermediary Services (FAIS) Act.

Despite this recognition, FSCA's head of regulatory frameworks, Eugene Du Toit said that cryptocurrencies are not legal tender in the country.

The FSCA has also published a Policy Document supporting the Declaration. The Policy Document clarifies the Declaration's effect, including transitional provisions, and the approach the FSCA is taking in establishing a regulatory and licensing framework that would be applicable to Financial Services Providers (FSPs) that provide financial services in relation to crypto assets.

Why it matters: With this official recognition, FSCA and other regulators will be able to tackle crypto scams and protect customers.

What it means: Per the Declaration, Unathi Kamlana, the FSCA'S Commissioner, a crypto asset means a digital representation of value that:

- is not issued by a central bank, but is capable of being traded, transferred or stored electronically by natural and legal persons for the purpose of payment, investment and other forms of utility;

- applies cryptographic techniques;

- uses distributed ledger technology.

In addition to the Declaration and Policy Document[pdf], the Authority also published a general exemption for persons rendering financial services (advice and/or intermediary services) in relation to crypto assets, from section 7(1) of the FAIS Act.

Zoom out: In July 2022, the South African Reserve Bank (SARB) also recognised cryptocurrencies as financial assets. With the aforementioned moves, South Africa has joined the list of other African countries with conflating crypto stance.

In the last letter, we told you that the Bank of Namibia (BoN) disclosed that although the Namibian Dollar is still the only recognised legal tender, merchants are allowed to accept payment in the form of cryptocurrencies.

Recall that in April 2022, the Bank of Uganda instructed all licensed entities to desist from facilitating cryptocurrency transactions. However, in an interview in May 2022, the Bank said that it "hasn’t banned cryptocurrency, we have simply applied some speed brakes".

In the same month, Nigeria's Security Exchange Commission said that entities that intend to offer crypto-related services or products in Nigeria must secure a Virtual Asset Service Provider (VASP) licence. This regulatory position contradicts the Central Bank of Nigeria's stance on cryptocurrency in the country.

Receiving international payments shouldn't be hard!

Easily create a USD, GBP & EUR virtual bank account to receive foreign payments for your work. Geegpay provides: Instant account verification, USD virtual account that supports ACH & local wire transfers, the best exchange rates and the fastest payouts to banks

3. Wise halts dollar transfers to Nigeria

The News: Starting November 1, 2022, international money transfer operator, Wise (formerly TransferWise) will suspend dollar transfer transactions to Nigeria.

"Unfortunately, we can no longer support USD transfers to Nigeria. We’re doing this because we’re currently not able to offer our customers the service they’d expect from us," a Wise spokesperson stated.

Why this is happening: Analysts have speculated that beyond customer service issues, the recent foreign exchange (FX) restrictions by the Central Bank of Nigeria (CBN) might be the reason behind the suspension.

Recall that, the CBN in 2021 stopped dollar sales to Bureau De Change operators and instructed Deposit Money Banks (DMBs) to set up teller points in designated branches to serve FX requests for Personal Travel Allowance (PTA), Business Travel Allowance (BTA), tuition fees, medical payments, SMEs transactions amongst others, in order to meet legitimate FX demands.

The DMBs have not met up to these expectations thereby leaving a gap for black market operators to fill, many of these financial institutions have set caps on dollar transactions via local debit cards.

Zoom out: In April 2016, Wise (then TransferWise) disclosed that it will no longer support Naira transfers, a decision that was preceded by an FX crisis.

Later in 2020, the CBN said that Wise and Azimo were both unauthorised as International Money Transfer Operators (IMTOs) in Nigeria.

This link is similar to the incidence with Union54, and several virtual dollar card providers in Africa.

🧩 BD Trivia

These logos have been arranged according to various sectors, pick the odd one out:

🧩 Another week comes with another #BDtrivia. pic.twitter.com/c2eocvyqrA

— Benjamindada.com (@bendadadotcom) October 22, 2022

💰 State of funding in Africa

Moove is on the move! The mobility-fintech company secured £15 million ($16.7 million) from Emso Asset Management to scale up its UK operations. This is the fourth time the company has raised this year making it a total of $150 million—in equity and debt funding.

The table below details how African startups jointly raised over $79.20 million last week. Get free access to our carefully-curated, real-time updated Funding Database for 2022.

📚 Noteworthy

Here are other important stories in the media:

- Inside Afropolitan's plan to build an internet country for Africans: In this article, Eche Emole, co-founder and CEO of Afropolitan shared how the community-as-a-service company for the African diaspora wants to build the world's first-ever internet country.

- The Nigeria Startup Bill is now a law: Last week, Nigeria's President Muhammadu Buhari assented to the Nigeria Startup Bill to drive the growth of the country's tech ecosystem.

- Lagos to launch VC Fund writing bigger cheques than before: The Lagos state government has disclosed its plan to launch a venture capital fund to enable Nigeria's tech ecosystem.

- Who is enforcing data protection regulations in Nigeria?: Since February 2022, the Nigeria Data Protection Bureau (NDPB) took over data protection enforcement responsibilities from the National Information Technology Development Agency (NITDA).

- Seven things to do before relocating to Canada: Relocating to Canada from another country is no mean feat. It is a big decision which shouldn’t be underestimated by no means. Here are seven things you should do before relocating.

💼 Opportunities

Jobs

Every week, we carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth.

Product & Design

- EdenLife — Product Designer (Lagos)

- TeamApt — Technical Product Manager (Lagos)

- Paystack — Product Specialist (Ghana & Nigeria)

Data & Engineering

- Turaco — Software Engineer (Kenya)

- Bumpa — Software Engineering Manager (Lagos)

- Interswitch — Team Lead, Compute & Storage (Lagos)

Admin & Growth

- TikTok — Content Partnerships Lead (Lagos)

- Binance — Community Manager (West Africa)

- Smile Identity — Marketing Director (Kenya, Nigeria, South Africa)

Other opportunities

- For law students interested in tech law: Vazi Legal Internship application for the 2022 Winter Cohort is open.

Events

The conversation will be led by David Adeleke, the Founder of CMQ Media; Peace Obinani, Product Marketing Manager at Piggyvest and Jeremiah Ajayi, Senior Content Marketer at Stears.

Set a reminder!

To advertise with us, please reach out to david@benjamindada[dot]com, and cc: hello@benjamindada[dot]com.

Comments ()