BD Insider, Letter 123

Letter 123 of BD Insider covers the additional 5% telecoms tax in Nigeria, CBK's cease and desist order regarding Flutterwave and Chipper Cash.

For Letter 123, we will look at:

- additional 5% tax on call, text, and data for telecom subscribers in Nigeria

- why Kenyan Banks will stop transacting with Flutterwave and Chipper Cash

- Kenya and the internet ahead of the August 9th election

- the latest African Tech Startup Deals (in PNG and an interactive format)

- job opportunities, events, and more.

Telco subscribers in Nigeria set to pay 5% tax on Data, et al.

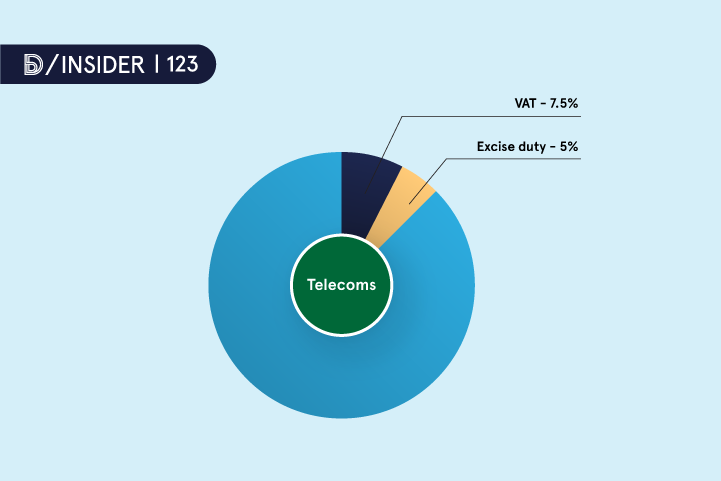

The news: The Federal Government of Nigeria has disclosed that telecommunications subscribers would pay a 5% excise duty on calls, SMS and data services as part of the 2022 Fiscal Policy Measures and Tariff Amendments [pdf].

Why it matters: According to local reports, the 5% tax will be added to the already existing 7.5% Value Added Tax (VAT) on telecommunications services. "It is public knowledge that our revenue cannot run our financial obligations, so we are to shift our attention to non-oil revenue," Nigeria's Finance Minister, Zainab Ahmed said.

The resistance: However, telecom operators have kicked against the implementation of the 5%. According to the Executive Secretary, Association of Telecommunications Companies of Nigeria (ATCON), Ajibola Olude, "the proposed excise duty on all telecommunications companies is badly intended by the Ministry of Finance. And the current state of Nigerian communication is so bad that only about 756 Internet Service Providers (ISPs) were registered but only 10 are active because of issues with forex."

Normally, excise duty is applicable on beer and stout, wines, spirits, cigarettes, and homogenised tobacco manufactured in or imported into Nigeria at 20%. With the Finance Act 2022, Nigeria has introduced excise duty on non-alcoholic beverages including telecommunication services.

Subscribers' burden: "It is a strange move, it appears a bit unusual. Excise duty is supposed to be apportioned to goods and products, but we are surprised this is on services. We will continue to support the government but ALTON won’t be able to subsidise this on behalf of subscribers in addition to the 7.5% VAT, making it 12.5% subscribers to the Federal Government," the Chairman of the Association of Licensed Telecoms Operators of Nigeria (ALTON), Gbenga Adebayo said.

Zoom out: At a time when other Governments are looking to boost digital penetration, this tax could slow down Nigeria's rate of digital adoption.

Send and receive payments with Fincra

With Fincra, customers can pay you via cards, bank transfers, and virtual accounts, and you will get paid into your Fincra Wallet with no hidden fees. You can also make seamless payouts to business partners, suppliers, and contractors across 100+ countries.

Kenyan banks to halt transactions with Flutterwave and Chipper Cash

The news: The Central Bank of Kenya (CBK) has ordered financial institutions in the country to "cease and desist from dealing with Flutterwave and Chipper Cash".

In a letter dated July 29, 2022, CBK's Deputy Director of Bank Supervision, Matu Mugo ordered the Chief Executive Officers of these institutions to comply with the directives within seven days.

Why it's happening: "It has come to the attention of the Central Bank of Kenya (CBK) that Flutterwave Payments Technology Limited (Flutterwave) and Chipper Technologies Kenya Limited (Chipper) have been engaging in Money Remittance and Payment Services without licensing and authorisation by CBK," Mugo said.

This letter was sent a day after CBK's Governor, Patrick Njoroge said that the fintech unicorns are unlicensed in the country.

However, Yewande Akomolafe-Kalu, Flutterwave's Head of Branding and Storytelling argued that "like many other financial technology service providers in Kenya, [Flutterwave] entry into the market was through partnerships with banks and mobile network operators licensed by the Central Bank of Kenya."

CBK is snubbing these unicorns: Yewande added that Flutterwave submitted its application for a Payment Service Provider licence in 2019. "We have been in constant engagement with the Central Bank of Kenya to ensure that we provide all the requirements and we look forward to receiving our licence," she said.

Although Chipper Cash has not made any public comment on the issue, Leon Kiptum, the Country Director for Chipper Cash in Kenya told HapaKenya in January that "Chipper Cash was not well guided until someone with experience joined the business. Initially, we were operating in partnerships with companies that have licenses. The laws have since changed, and we had a window to apply for the required licenses for operations and comply with the new regulations."

According to Kiptum, the fintech company needs two licenses (to operate in Kenya)—a Payments Service Provider (PSP) license which allows you to have a wallet, and an International Money Transfer Operator (IMTO) license. He revealed that Chipper Cash has applied for the IMTO license and is awaiting approval.

Kenya has no plan to shut down the internet — ICT Secretary

The news: Ahead of Kenya's August 9th elections, Joe Mucheru, ICT Cabinet Secretary has said that the Kenyan government has no plan to shut down the internet despite the ongoing misinformation on social media.

Last week, Kenya's ethnic cohesion watchdog, the National Cohesion and Integration Commission (NCIC) directed Facebook to stop the spread of hate speech on its platform within seven days or face suspension in the East African country. "Not clear what legal framework NCIC plans to use to suspend Facebook," Mucheru tweeted.

So far: Social media companies including Facebook and TikTok have been modifying their platforms to avoid the spread of misinformation. Meta—Facebook's parent company—has established operations centres for major elections around the world since 2018, including in Kenya.

Within the [ongoing] campaign period, Facebook removed 37,000 pieces of content for violating its Hate Speech policies on Facebook and Instagram in Kenya, as well as 42,000 other pieces of content that violated our Violence & Incitement policies.

TikTok also launched an in-app guide to enable access to factual and authoritative information ahead of the elections. The social media platform was accused of fueling misinformation and political tension in Kenya. Kenya has experienced significant electoral violence in previous elections.

Zoom out: In April 2022, Kenya distanced itself from a US listing as among 60 signatories to an agreement that commits members from arbitrarily shutting down the internet. In the past four years, citizens in close to half of African countries have experienced an internet blackout.

Smile for Success

Get $10,000 in usage credit and unlimited access to all Smile Identity products

Apply💰 BD Africa Funding Tracker

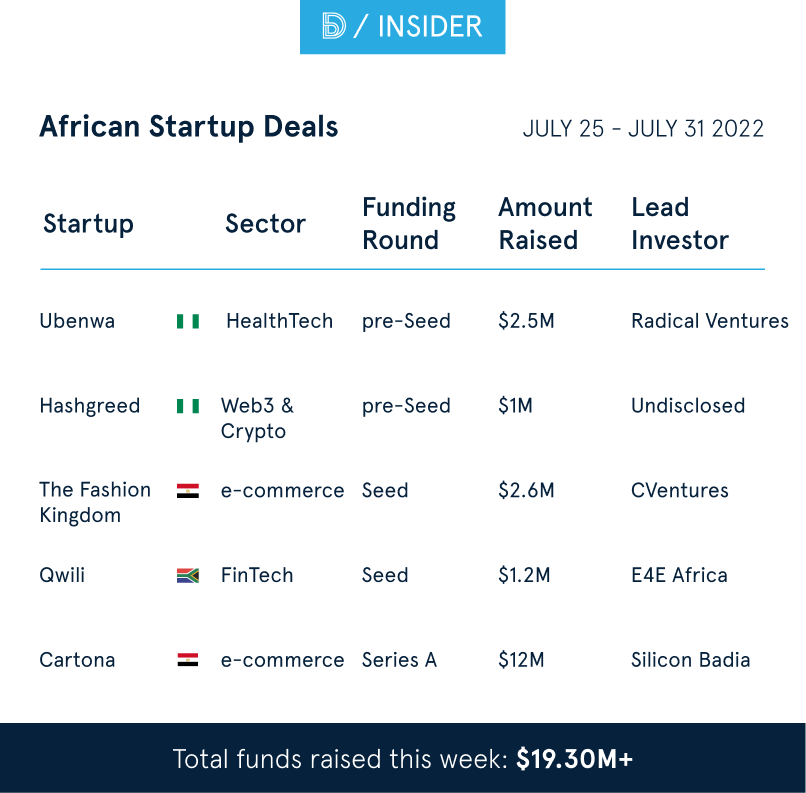

In the last week of July, Egypt's Cartona raised the highest funding amount via their $12 million Series A.

That said, Nigeria had more reported deals than Egypt in that same time period.

Get full access to our BD Funding Database.

📚 Noteworthy

Here are other important stories in the media:

- The Nigeria Startup Bill is now awaiting Presidential assent.

- Telkom sues South Africa's President, Cyril Ramaphosa. Find out why.

- YouTube Music has selected Joeboy and Black Sherif for the Foundry Class of 2022.

- Home to Lagos, the South-West region of Nigeria houses more than half of all the SMEs in Nigeria, according to Kippa's Nigeria MSME Report 2022.

- Facebook is trying to copy TikTok, the New Yorker thinks that it might be the end of the social media giants.

- Elon Musk's father claimed that he has been asked to donate sperm to impregnate high-class women and create a new generation of Elons.

🧩 BD Trivia of the Week

How in touch are you with funding rounds?#BDTrivia pic.twitter.com/LuurdQssvx

— Benjamindada.com | Premium tech blog (@dadabenblog) July 29, 2022

Remember, you stand a chance to win a free feature for your favourite startup when you answer the question correctly on Twitter.

BD Trivia always comes up on Friday, so be on the lookout.

💼 Opportunities

Jobs

Every week, we carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth.

Product & Design:

- Kora — Senior Product Manager (Lagos)

- Jobberman — Product Manager (Lagos)

- uLesson — Animator/Motion Graphic Artist (Abuja)

Data & Engineering:

- uLesson — Data Analyst (Abuja)

- Nomba — Frontend Engineer (Lagos)

- QuickCheck — Senior Software Engineer (Lagos)

Admin & Growth:

- Chipper Cash — Country Director (Nigeria)

- Visa — Marketing & Digital Director (Lagos)

- Zipline — Community Lead (Bayelsa, Nigeria)

Other opportunities:

- For startups: Apply for the Smile For Success program to get $10,000 in usage credits to enable identity verification at your startup.

- For fintech startups: Application for the 2nd cohort of the Fintech Incubation Programme is open.

- For women (and men): Apply for Stutern's African Tech Sis Scholarship to get 50% off to learn Product Design, Frontend, and Backend Engineering.

- For Lagos-based fintech and proptech startups: The ARMS Labs Lagos Techstars Accelerator Program is now accepting applications from early-stage African fintech and Proptech startups

Thanks for reading.

You can get in touch with us by emailing hello@benjamindada(dot)com and we'd reply within the hour.