BD Insider 162: Nigerian banks owe telcos ₦120 billion USSD debt

M-Kopa secures over $250 million in debt and equity funding. We also examine Wasoko's plan to invest over $1 million in Zambian expansion.

We are starting the week with two funding news.

Pan-African asset financing platform, M-Kopa has secured over $250 million in new funding. The investment includes $55 million in equity and over $200 million in debt, according to reports. It is one of the largest combined debt and equity funding that has been raised in the African tech ecosystem.

In Nigeria, Gricd has raised $1.5 million in a seed funding round led by Atlantica Ventures. With this funding, the company wants to expand across Africa and develop new solutions that will make it easier to insure perishable goods on the continent.

Meanwhile, inside letter 163, we cover:

- Nigeria telcos’ plan to disconnect USSD code used for banking

- Wasoko's plan to invest over $1 million in Zambian expansion

- why Ghanaian internet provider Surfline has shut down its data centres

and other noteworthy information like:

- the latest African Tech Startup Deals

- events, opportunities, interesting reads and more

The big three!

#1. Telcos to disconnect USSD codes used by Nigerian banks to deliver services to customers

The news: The Nigerian Communications Commission (NCC) has approved mobile network operators (MNOs)—including MTN, GLO, Etisalat and Airtel—to disconnect deposit money banks (DMBs) over ₦120 billion USSD debt.

"The DMBs have continued to incur greater and greater debt, without making commensurate payments. Every time some progress is made, the DMBs come up with reasons to take stakeholders several steps back, in this matter," says Gbenga Adebayo, chairperson of the Association of Licensed Telecommunications Operators of Nigeria (ALTON).

Between October 2022 and now, the debt has increased by 50%.

Flashback: In April 2021, when the debt was at ₦45 billion, ALTON's plan to halt the USSD services was interrupted by intervention from the Central Bank of Nigeria (CBN) and NCC.

Following the intervention, the CBN introduced a ₦6.98 fee for each USSD transaction session to be remitted to MNOs, who provide infrastructure for the services to operate, directly from customers’ bank accounts.

ALTON alleged that the banks are not cooperating in paying the debt despite interventions from the government. "Banks remove charges from their customers but refuse to pay telecom operators. You don’t expect us to keep rendering services when you don’t pay," according to Gbenga.

What now? If ALTON disconnects the USSD services, customers will be unable to make transactions using the various Bank short strings. "It is pertinent to note that the contract between MNOs and DMBs on the use of USSDs for banking transactions is strictly commercial and MNOs are at liberty to withdraw the services if it is established that the transaction is unprofitable to them," ALTON said.

The DMBs are yet to comment on the issue.

#2. Wasoko wants to invest over $1 million in its Zambian expansion

The news: Last week, African B2B e-commerce company Wasoko expanded into Southern Africa, starting with Zambia. With the goal to build a central hub in Zambia’s capital city, Lusaka, Wasoko says it will invest $1 million in its first year of operations.

Wasoko, which was founded in 2014 by Daniel Yu, wants to centralize its operations in Lusaka before expanding regionally in Southern Africa.

In March 2022, the company raised a $125 million Series B at an estimated valuation of $625 million. At the time of this funding, Wasoko disclosed its plan to expand into Southern Africa and Nigeria.

Why it matters: "With high smartphone usage and a pro-business government administration keen on expanding the country's digital economy, Zambia is an ideal environment to launch our model and strongly aligns with our current core markets, both in terms of similar regulatory practices and a supplier base that is intertwined with East Africa," says Daniel Yu.

Despite his optimism, Zambia is currently facing economic challenges due to debt restructuring. The country's 2023 GDP growth is projected at 4.2%, a decrease compared to the 4.7% growth that was recorded last year. "Our business still remains very well-capitalised with a multi-year runway and our investment plans for 2023 are unaffected," according to Yu.

Zoom out: In addition to the Zambian expansion, Wasoko says it will double down its offering in Kenya, Tanzania, Rwanda, and Uganda. Since its launch, the company has built a network of over 200,000 informal retailers and fulfilled more than five million orders.

Last year, the company launched the “Wasoko Innovation Hub” in partnership with the Zanzibar government for “Silicon Zanzibar” - a new government initiative to attract and relocate tech companies from across Africa to the island.

#3. Surfline to shut down data centre in Ghana

The news: Surfline, the first telco to offer 4G LTE services in Ghana wants to shut down its operations in the country due to increased operational costs.

"Over the years they have had challenges...we have been aware they are looking for strategic investments and partnerships. We’ve been helping them a lot but the conversations didn’t materialize...so for now their expenditures and debts outweigh their revenues and cost of providing services," says Ursula Owusu, Ghana's comms minister.

Owusu also said that Surfline has since closed its data centres. The company has recorded more than three downtimes this year, based on data available on its social media pages.

Zoom in: A note on its website reads: "Surfline has, in the past few days, experienced a total network downtime, resulting in a service interruption for some of you. Please be assured that Surfline management is working very hard with all stakeholders to resolve the matter. It goes without saying that the validity of your data bundle will be extended proportionally, once the network is up again. Surfline will also ensure that you, as our cherished customers, are compensated for all the inconvenience. We are grateful to you for bearing with us and very much appreciative of your custom."

However, Joe Anokye, the director of Ghana's National Communication Authority told local media that "Surfline actually wrote to us that they shut down their data centre. Prior to that, they informed us that they were shutting down their radio access network because of cost."

Surfline sufferings: In 2018, Surfline's head office in Accra was closed down by Ghanaian authorities over tax default. At the time, the internet provider was owed more than 37 million Ghana cedis (that is ~$1.4 million based on current FX).

Prior to the aforementioned, Surfline suffered a service interruption in 2015 due to a fire outbreak at its data centres.

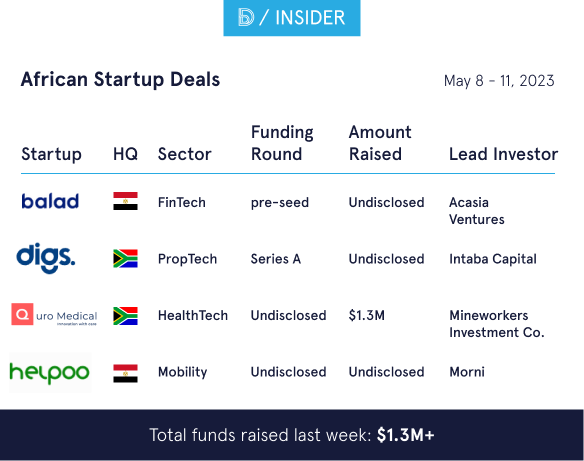

💰 State of funding in Africa

Find below a summary of the venture capital that was raised by African tech startups last week.

📚 Noteworthy

Here are other important stories in the media:

- How Fullgap is tapping into the new world of work with Africa’s HoneyBook: Fullgap is building the operating system for freelancers. In just three weeks of the public beta launch, they acquired their first 3,000 users. Benjamin talks to two of the co-founders about their plans for the company.

- Competition hits up in Ethiopia's mobile money market: Last week, Safaricom obtained a licence to expand its M-Pesa offering in Ethiopia, to compete against state-owned mobile money provider, telebirr who previously operated a monopoly.

- What we know about the Zimbabwean gold-backed digital currency: Zimbabwe has launched a gold-backed digital currency. It will be used as legal tender alongside the Zimbabwean dollar. Here's what you should know about the currency.

- Africa's B2B e-commerce startups are struggling to survive: Amid the global funding crunch, B2B startups are scaling back operations and laying off employees, reports Rest of World.

💼 Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- M-KOPA — Senior Product Designer

- Pulse Africa — Senior Graphic Designer

- Metacare — Visual Designer

Data & Engineering

- Wasoko — Senior Software Engineer

- Flutterwave — Engineering Lead

- Carry1st — Lead Data Engineer

Admin & Growth

- Bamboo — Senior Finance Associate

- Bolt — Local Communication Manager

- Kuda — Growth Marketing Specialist

Other opportunities

- Kenyan and Rwandan startups invited to apply for African Food Fellowship: Applications are open until May 15 for the 2023 cohort of Fellows from Rwanda and Kenya.

- In Nigeria, applications are open for Global Cleantech Innovation Programme: The programme offers support for individuals who are passionate about clean technologies, tackling climate change and making a positive impact.

- Applications open for the second GSMA climate resilience fund: African cleantech startups can apply for the fund. Applications will be close on Tuesday, May 16, 2023

Have a great week ahead!