BD Insider 160: Report excludes Chipper, Andela and Flutterwave from the list of African unicorns

We examined CV VC's claim on the current state of African unicorns, the latest on SEC Regulatory Incubation program for Nigerian fintechs and the poor but expensive network in Cameroon.

I read a report last week that claims that some of Africa's unicorns have lost their horns. The report excluded Flutterwave, Chipper and Andela from the list of billion dollar companies on the continent.

In this letter, we will examine this claim and other important stories, including:

- Nigeria’s SEC regulatory incubation program for fintechs

- the poor but expensive network in Cameroon

and other noteworthy information like:

- the latest African Tech Startup Deals

- an Insider Perspective on Nollywood's first game app

- events, opportunities, interesting reads and more

SEC rolls out Regulatory Incubation program for Nigerian fintechs

The news: The Nigeria Securities and Exchange Commission (SEC) has commenced applications for the SEC Regulatory Incubation (RI) program for fintechs operating or seeking to operate in the Nigerian capital market.

"The portal for submitting applications is now ready to receive applications from Cohort 001/23," the commission said in a statement, last week. The application deadline is on May 26, 2023.

Why it matters: Before now, the proposed business models of some fintech companies were outside the existing SEC regulations, this prevented these fintechs to launch and operate in Nigeria.

The RI program is designed to address the needs of new business models and processes that require regulatory authorisation to continue carrying out technology-driven Capital Market activities.

"It is conceived as an interim measure to aid the evolution of effective regulation which accommodates innovation by fintechs without compromising market integrity and within limits that ensure investor protection," SEC says.

Dig deep: Participants of the RI program, according to SEC, are prohibited from carrying out any business other than what they've presented. Also, approved applicants are to on-board a maximum of 100 clients who will be duly informed of the products and services they offer. Meanwhile, existing fintechs are not required to on-board any more clients during the one-year period.

At the end of the incubation period, eligible participants are advised to apply to register and and the ineligible ones are required to terminate operations.

Flutterwave, Chipper, Andela lost unicorn status, report says

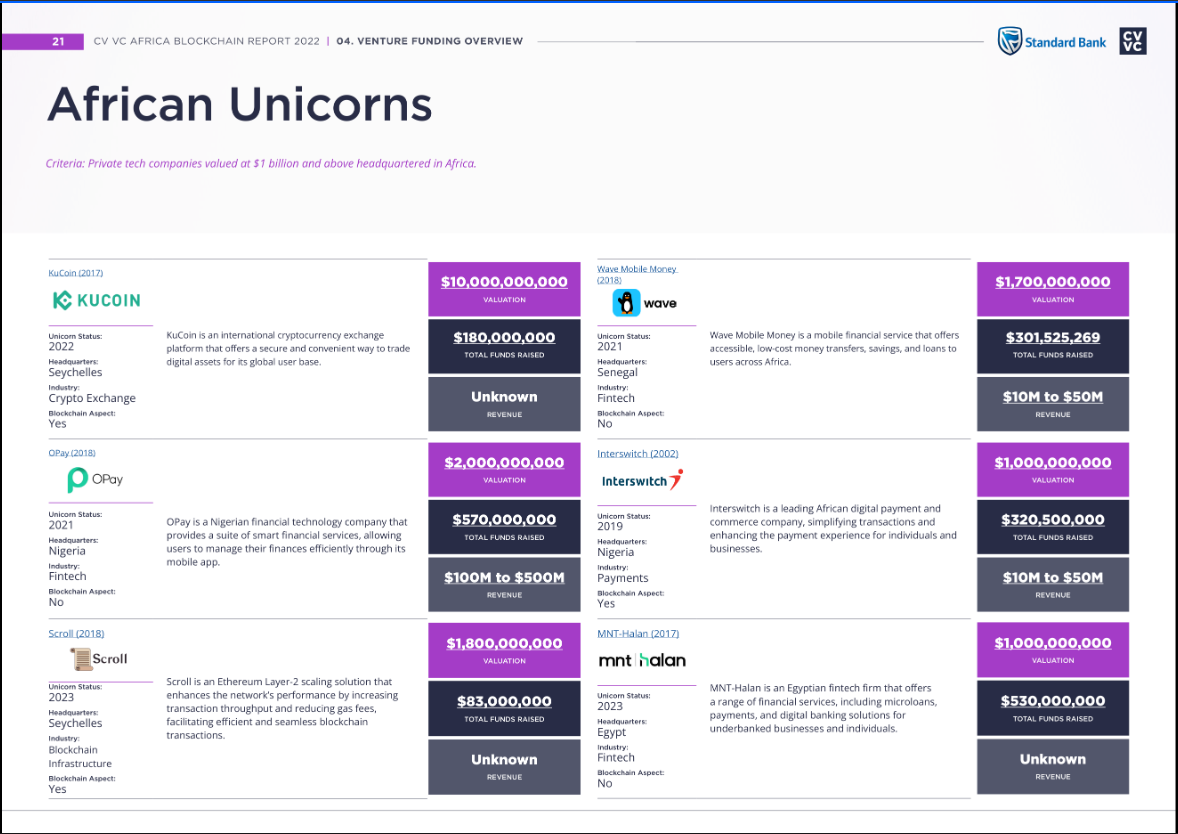

The scene: A 2022 African report by CV VC and Standard Bank claims that 50% of the continent's unicorns lost their status as a privately held startup valued at over $1 billion. Flutterwave, Andela and Chipper Cash were excluded from the list of existing African unicorns.

However, the report said that Interswitch, Opay, Wave and MNT Halan are still unicorns. In February, Egyptian fintech company, MNT-Halan attained its unicorn status in February, after raising $400 million at a billion dollar valuation, the first after a one year unicorn drought.

The report also added that Seychelles-headquartered blockchain companies; Kucoin and Scroll are the new unicorns on the continent.

Dig deep: Although it is unclear which metrics were used by CV VC, the continued economic downturn has led to a slowdown in venture funding and valuation slash.

The last time we reported about Chipper's valuation was last December, when it was reportedly slashed by 37.5%—from $2 billion to $1.25 billion earlier in the year. The company laid off over 50 employees, it was also exposed to the FTX and Silicon Valley Bank (SVB) collapse— "SVB owns a very small part of Chipper; [about] 2%," according to Chipper CEO, Ham Serunjogi.

In 2021, Andela raised a $200 million Series E at a $1.5 billion valuation. The company has raised at least $381 million since its first disclosed round in 2014. Recently, Andela acquired Qualified, a technical skills assessment platform, for an undisclosed figure.

Meanwhile, Flutterwave was last valued at $3 billion, after raising a $250 million Series D a year ago. The company's planned IPO was marred last year by scandals and continued regulatory challenges. "The timing of an IPO is a function of a number of factors, including but not limited to, market conditions," Flutterwave spokesperson said.

Flutterwave remains Y Combinator's most valuable African company, according to YC's 2023 list of portfolio company's that are valued at over $150 million.

Aside from Chipper, no valuation cuts have been disclosed by Flutterwave and Andela.

Responding to our request for comments, CV VC said that the three companies were excluded not based on valuation but headquarters. The VC firm has since removed the statement in the report that says "50% of Africa's unicorns lost".

Zoom in: "Outside of the market correction we've had over the last 12 months, the fundamentals of many leading African tech startups are at levels that would ordinarily command a unicorn valuation," Zachariah George, Managing Partner at Launch Africa Ventures, says. "Nonetheless, they’re delaying their next raises until the market gets better instead of raising at flat or down rounds caused by macro-economic market correction despite better fundamentals. So yes, there will be more unicorns in Africa, but mainly when the market has improved."

Cameroonians protest poor network, telcos pledge to fix issues

The scene: In the first two hours of last Tuesday afternoon, several Cameroon internet users switched their devices to “Flight Mode” to protest the poor quality of service offered by mobile networks operators in the country, especially MTN and Orange. The protest continued afterwards with the hashtag; #ModeAvion237.

Action? According to reports, the operators have been ordered by the Cameroonian authorities to immediately address the concerns.

"The state will always remain on the side of the population, to ensure their protection in terms of the provision of electronic communications services by the operators, all of which justify the establishment of effective strategies and policies, for the generalized and equitable adoption of said services, and a harmonious and inclusive development of digital technology in our country," Cameroon's minister of telecommunications, Minette Libom Li Likeng, said after a meeting with the operators last week.

During the meeting, each operator presented plans to improve quality of service in terms of coverage, pricing and investment. The country's Telecommunications Regulatory Board (TRB) disclosed the initiatives undertaken to ensure compliance with respect to specifications by the operators.

Zoom out: In 2019, TRB imposed a combined $6 million fine on mobile network operators in the country for failing to meet agreed network improvement targets. However, little has improved since then. "Data rates are enormously high but the bad network is recurrent," one of the subscribers told Benjamindada.com.

💰 State of funding in Africa

Another acquisition! Last week, Smile Identity annnounced the acquisition of Inclusive Innovations—the parent of Appruve, a Ghana-headquartered ID verification company. With this acquisition, Smile Identity says it will deepen its presence in Ghana and expand into francophone Africa, focusing on Cote D'Ivoire and Senegal.

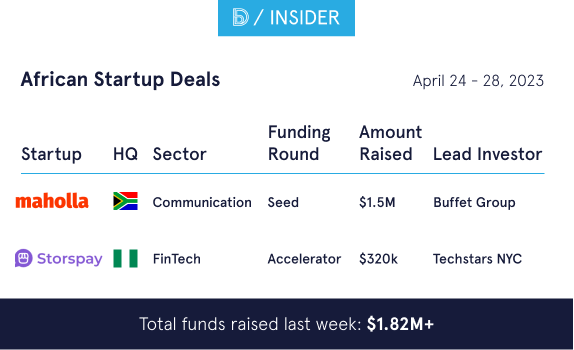

Meanwhile, venture funding is still on the low. In April, African startups raised ~$217.8 million across 16 deals, a 40.5% decrease compared to the same period last year, according to BD Funding Tracker.

🎙 BD Talks: Curating data for venture funding in Africa

The methodology used by various African venture funding trackers, including ours, differ—this has led to continued disparity and often times users, like yourself, find it difficult to understand which data is authentic.

Later this evening, we will host Olanrewaju Odunowo; Head of TechCabal Insights Yinka Awosanya; Lead at Intelligence by Techpoint and Benjamin to discuss how to curate data about venture funding in Africa.

💬 The Insider's perspective

Last week, Nigerian movie producer, Play Network Africa launched Aki and Pawpaw Epic Run, Nollywood's first mobile game app modelled after the popular 2002 comedy; Aki Na Ukwa.

We asked Adedimeji Quayyim, Film Journalism Fellow at Inside Nollywood about what this means for the Nigerian film industry.

I think the gaming industry is a prime market Nollywood needs to tap into, and Play Network is creating that necessary nexus. This new game would further foster the industry's marketability, and also boost the market's march to global domination.

📚 Noteworthy

Here are other important stories in the media:

- How collaboration between banks and fintech is driving financial inclusion in Africa: Closer collaboration between banks and fintech companies is a positive development and has the biggest potential to drive financial inclusion in Africa.

- Hover transitions to an open source community: Due to its inability to raise additional funding, Stax's parent company is transitioning from a full-time team to an open source community.

- Why social entrepreneurs need to stop relying on grants: Karl Nchite, Impact Lead & Investment Associate at Goodwell Investment talks about impact investing in Africa and why social entrepreneurs should not rely on grants.

- Africa fell in love with crypto. Now, it’s complicated: Rest of World reports on how trust is fading, startups are shutting down, and Web3 workers are reconsidering their career choices.

- How much can Duolingo teach us? The company’s founder, Luis von Ahn, believes that artificial intelligence is going to make computers better teachers than humans.

💼 Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Mastercard — Manager, Product Management

- Seerbit — Senior UI/UX Designer

- Dayra — Product Manager

Data & Engineering

- Vendease — Data Scientist

- Kobo360 — Software Engineer

- Nomba — Senior Backend Engineer

Admin & Growth

- Glovo — Brand Partnership Associate

- Turaco — Contact Centre Associate

- Brass — Head of Business Banking

Have a great week ahead!

Comments ()