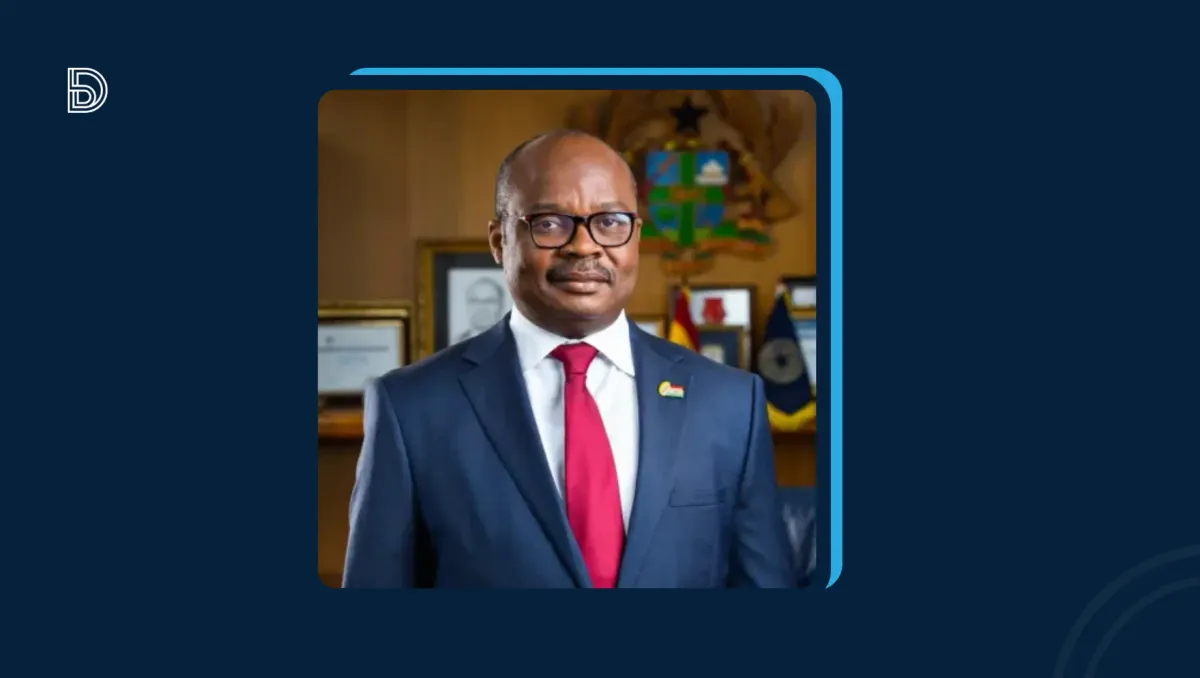

FACT CHECK: Bank of Ghana did not prohibit the opening of dollar accounts

The Bank of Ghana stated that it had not issued any directive to local banks to stop opening new dollar accounts

The Bank of Ghana (BoG) has flagged media reports stating that it has directed local banks to stop opening new dollar accounts as "fake".

Public Notice: Bank of Ghana has not issued any directive to local banks to stop the opening of new dollar accounts. pic.twitter.com/ileuPgxBFT

— Bank of Ghana (@thebankofghana) August 15, 2022

This is coming on the back of the rapid depreciation of the Ghanaian Cedi against the US dollar. The Cedi dropped by 47.10% against the US dollar since January, making it the world’s second-worst performing currency after the Sri Lankan rupee.

There has been a rise in the opening of dollars and other foreign exchange accounts over the past couple of months.

The BoG previously said it has introduced measures to resolve the fall of the Cedi. Identifying the five reasons for the depreciation of the local currency, the apex bank stated that they were: the strength of the US dollar, investor reaction to a credit rating downgrade, non-roll over of maturing bonds, the sharp rise in crude oil prices and impact on the oil bill, and finally the loss of external financing.

Measures introduced to resolve the problem were a Gold Purchase Program to increase foreign exchange reserves; Special Foreign Exchange Auction for the Bulk Distribution Company (BDCs) to help with the importation of petroleum products; Bank of Ghana entering into a cooperation agreement with the mining companies to provide BoG with the opportunity to buy gold as when it becomes available.

In April, the Bank of Ghana issued a reminder warning citizens, and companies to stop transacting business, pricing goods and services and advertising in foreign currencies. Although the Foreign Exchange Act, 2006 (Act 723) prohibited the pricing and payment in currencies other than the local currency, some institutions, companies, and individuals still go ahead with foreign exchange trade without authorisation from the bank.

Related Article: Savaging the woes of the Ghana Cedi

BoG said it is illegal for individuals, companies, institutions, and others to engage in foreign exchange business without an appropriate licence from the regulator. It's important to note that the Bank has previously issued this notification, however, as the Cedi continues to decline and it's important to reiterate the caution.

To further seek solutions to the ongoing situation, the Monetary Policy Committee of the Bank of Ghana held an emergency meeting on August 17, 2022, to review recent developments in the economy.

Recall that in June, hundreds of Ghanaians were in the streets for days, protesting against worsening economic hardship in the country.

Neighbouring country Nigeria, is also experiencing six consecutive months of increased inflation. The July 2022 inflation rate (which stands at 19.64%) is Nigeria’s highest since 2005.

Comments ()