Three years after exiting his first startup, Segun Adeyemi launches Anchor, a YC-backed BaaS fintech

Segun Adeyemi has launched a new startup, Anchor, three years after he exited Amplifypay. Anchor becomes the first BaaS company to be backed by YC.

There have been several reports about the size of the African financial inclusion opportunity, particularly in reference to the provision of digital financial services to a continent of about 200 million youths. Beyond the sheer market size, two promises drive the rise of fintechs on the continent.

The first promise is the ability to solve pain points, while the second is the opportunity to create new market verticals.

There are pain points of inconvenience along the banking service value chain like long queues at banks for account opening and customer support. At the same time, there are opportunities for companies with an existing customer base to earn more income by providing financial services to their users.

Stripped down, banking services refer to account opening, deposit taking, funds transfer, card issuance, savings and investment mobilization, and lending.

Starting in 2015, fintech startups in Nigeria began to unbundle banking services. We had many startups launch card processing companies. Then came the savings-led startups, and lending-focused startups. Yet, between 2018 and 2020, financial exclusion in Nigeria decreased by only 1 percentage point, from 37% in 2018 to 36% in 2020. This implies that there is still a long way to go before market saturation.

Of that 2015/2016 era came a payment startup that focused on easing recurring payments via direct debit. Within three years of operation, a lending company, OneFi (aka Carbon) acquired the payments company. The payment company name is Amplified Payment Systems Ltd. (aka Amplify or Amplifypay). Amplify was co-founded by Segun Adeyemi who told TechCrunch, at the time, that he will “likely start another company."

Amplify's exit was one of the rarities in the budding Nigerian and African tech ecosystem. Three years after exiting Amplify, Segun founded another company—Anchor. Still focused on financial services, but closer to the metal (infrastructure) and going beyond payment.

"After Amplify, I worked with JUMO, a company that offers credit infrastructure to MNOs across Africa. During this period, I advised and consulted for some fintech companies including the biggest digital bank in Nigeria", says Segun Adeyemi, CEO of Anchor. "These experiences exposed me to the painful process of closing banking partnerships, negotiating third-party contracts, and obtaining regulatory approvals. And more generally, the extensive time and effort required to launch financial products. The interesting part is the similarity in the underlying infrastructure, irrespective of the unique value propositions. Everyone was re-building the same thing."

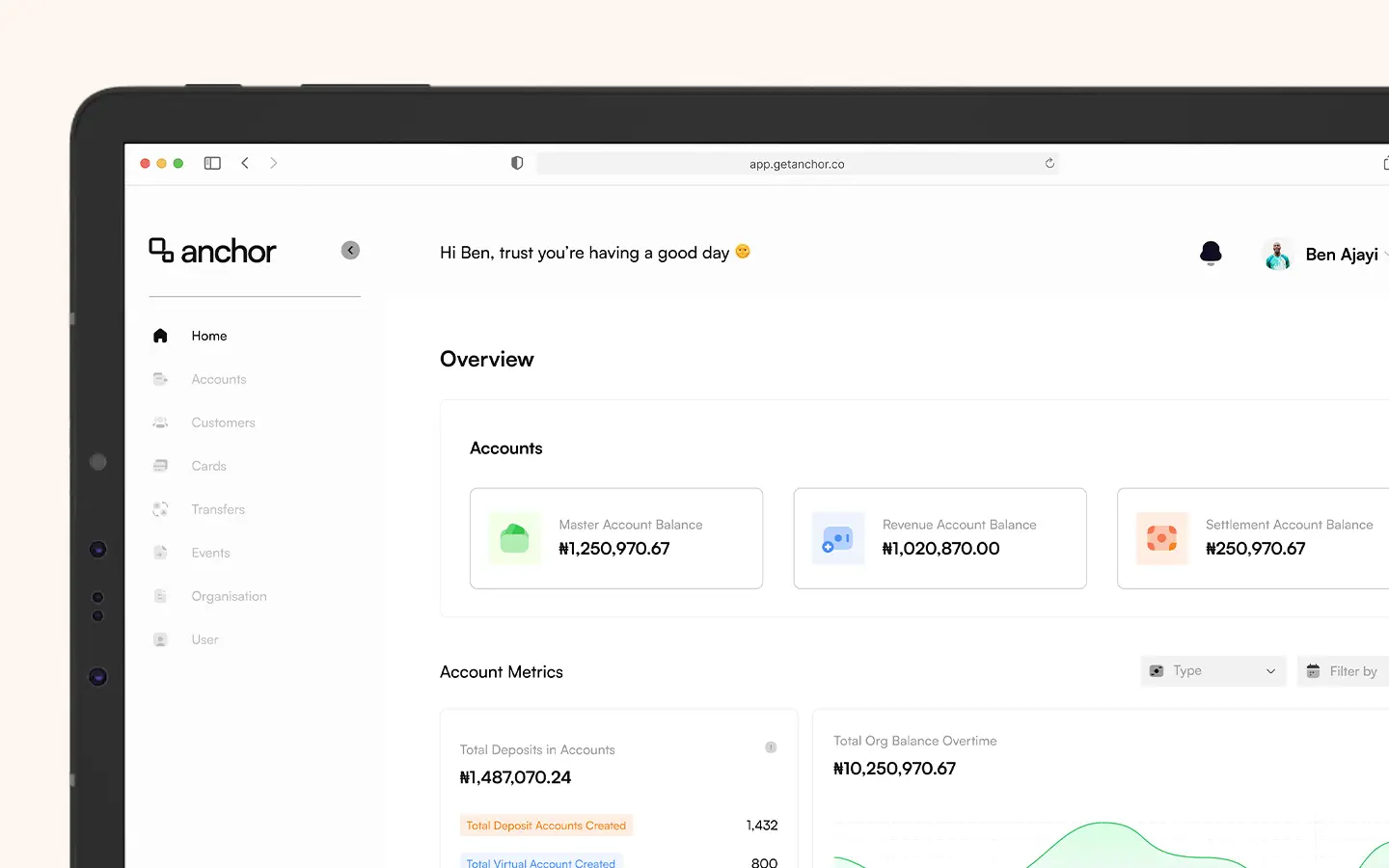

"With Anchor, we provide the banking APIs and infrastructure to businesses as a service. This allows businesses to focus on; building unique value propositions, getting to market fast, and acquiring customers”, says Segun Adeyemi.

Unlike Segun’s first startup, Anchor has three co-founders—himself, Olamide Sobowale (CTO), and Gbeke Olufotebi (Engineering Lead). Combined, Olamide and Gbeke bring engineering depth with strong local nuance and global exposure to the Anchor founding team. For context, Olamide has worked at AppZone, TeamApt, Kuda, & Carbon. While Olamide was at TeamApt he worked as a Fullstack Engineer that built the first virtual payments product in Nigeria. Gbeke has been an IT Consultant and entrepreneur for most of his professional life before joining Booking.com as a Fullstack Developer.

Founded in February 2022, Anchor has accomplished three major feats—raised a pre-seed round, launched in private beta, and was accepted by Y Combinator into the 2022 summer batch.

Anchor's undisclosed pre-seed round was led by Byld Ventures—a London-based VC fund—with participation from Niche Capital, Y Combinator, Mountain Peak Capital & Stitch. A handful of angel investors that also participated include Emmanuel Okeleji—CEO of SeamlessHR, Yinka Odeleye—a Finance Expert, and oil & gas executives— Sanmi Famuyide & Ado Oseragbaje.

According to Ashutosh Desai, a Partner at Y Combinator, "Anchor’s embedded finance platform enables technology companies in Africa to build products that can rapidly expand access and improve the quality of financial services. We’re excited to back Segun, Olamide, and Gbeke - a highly technical and experienced team - in building financial infrastructure that’s essential for Africa’s economic growth."

"I believe BaaS will play a prominent role in the distribution of financial services in Africa. As a full stack baas provider, Anchor demarcates customer engagement from infrastructure - enabling its customers to focus on building differentiation as opposed to commodity infrastructure. We are really excited to be working with this determined and experienced team," Founder of Byld Ventures, Youcef Oudjidane said in a statement seen by Benjamindada.com.

Within three months of private beta, Anchor has transacted millions, growing over 200% MoM. The company works with innovative startups like Outpost Health, Dillali, Pivo, Venco, etc with 40+ companies on its waitlist.

As a next step, Anchor has now launched a public beta for African businesses to embed finance into their offerings and for fintechs to build banking products. Anchor will take part in the upcoming YC Demo Day.

"Companies should not have to wait for years and spend millions to test their models. And that’s why we can’t wait to get Anchor into the hands of many more businesses via our public beta launch," adds Segun.

Comments ()