Nigerian lending fintech, Aella Credit raises $10 million

Aella Credit raises $10 million in debt financing, expands into other product lines including a blockchain-based lending market, Creditcoin.

Aella Credit has announced new funding of $10 million.

Founded in late 2015 by Akin Jones, and Akanbi Wale, Aella has been operating with a commitment to provide trustworthy credit to emerging markets with an initial focus on Nigeria and the Philippines, where the company is licensed to operate.

Lack of access to credit and financial services has been the main impediment to MSME growth and poverty reduction in several emerging economies. Aella’s commitment to providing trustworthy credit to millions of people in the world’s emerging markets is improving financial inclusion, enabling MSME expansion and accelerating economic growth and this raise will allow us scale our expansion across Africa quickly.

Nigerian adults are not one to borrow, a survey by Enhancing Financial Inclusion Access (EFInA) reveals. According to their last published report, of the 99.6 million adults, only 29.7 million (31%) accessed credit. And the bulk of the loan they took, came from family & friends (77.7%) and informal sources (23.2%) as opposed to credit from formal sources including the bank (8.3%).

Financial exclusion in Nigeria affects majorly women. EFInA's report shows that 40.9% of 49.9 million adult women are financially excluded, whereas only 32.5% of 49.7 million adult men are excluded. In the same vein, adult men are more banked (46.1%) than adult women (33.3%). Thus, adult women have come to rely on "formal-other" (non-bank) channels in gaining access to finance (9.1%) while only 8.9% of adult men rely on formal-other financial services.

Therefore, it is no surprise to learn that a non-bank channel like Aella has 45% of its 300,000 borrowers are female. Aella Credit offers employer-backed and Direct-to-Consumer financial services to their users.

This debt-financed round is Aella’s second raise and will bolster the company’s commitment to serve the underbanked population in West Africa and other emerging markets. They will use this funding to scale their lending operations and expand their product base into payments, according to a statement sent to benjamindada.com.

The $10 million funding comes from a Singapore-based private company, HQ Financial Group (HQF) specializing in new material science, semiconductor and blockchain financial investments.

As such, Aella will also invest in new products including a blockchain-based lending market called Creditcoin, to build borrower creditworthiness and aid in the acquisition of one million additional users by the end of 2020, making it the largest blockchain-backed financial services project that is currently operational.

Sun Han Gyu, Chief Executive Officer of HQ Financial Group said “We are excited to announce our partnership with Aella Credit which will significantly aid in the proliferation of micro-loan services to the underserved African populations who are unable to access banking services. HQF is impressed with their outstanding growth with very low default rate in the micro-loan business in Nigeria and look forward, through this initial investment of $10m to new growth opportunities in Africa and South Asia”.

HQF has deployed over $70m in investments since 2015.

Aella previously raised $2m seed funding at the US startup program, Y Combinator from seed investors including Michael Seibel of Y Combinator, Brian Armstrong of Coinbase, Bill Paladino (former head of Naspers eCommerce), Tae Oh, Shawntae Spencer (former San Francisco 49ers Cornerback), VY Capital, 500 Startups, Gluwa and others, which enabled it invest in digitalization and technology.

Over the last two years, the company has achieved significant growth with a 2-year compound annual user growth rate of 674%, over 193% increase in revenue and maintained a single-digit default rate.

Aella was also recognized by Amazon as one of the world’s leading financial organisations pioneering the use of facial recognition technology for customer authentication and credit scoring.

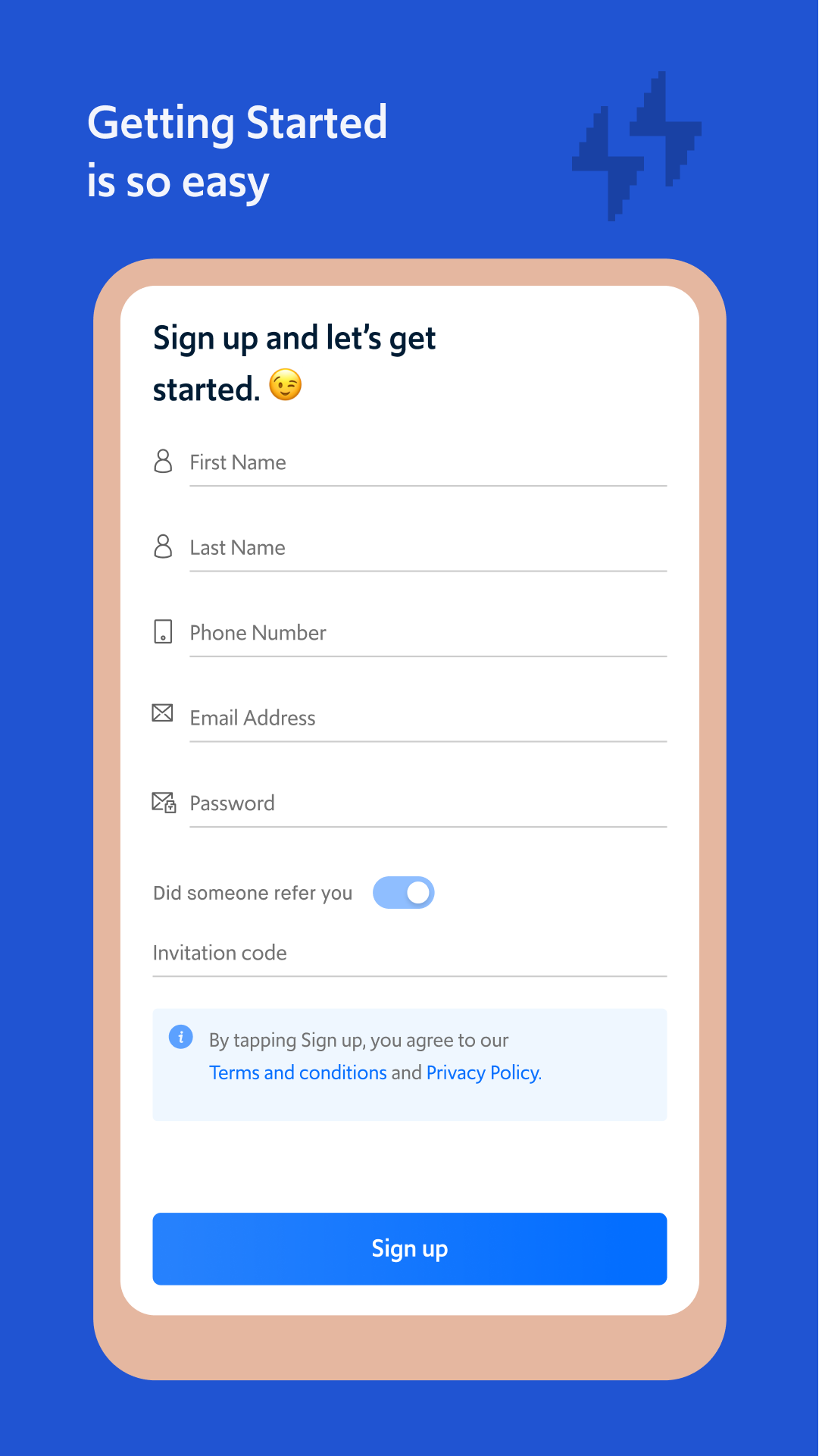

This raise marks the conclusion of the start-up’s evolution to a full-service lending and payments platform, poised to play a greater role in providing a wide bouquet of financial services across Africa. The company’s application will allow users to have access to loans, invest safely and securely, affordable insurance plans, bill payments and peer-to-peer money transfers.

“We are building a one-stop app for all transactions partnered with regulated industry leaders to help distribute products faster, better and cheaper to end-users in Nigeria and across the markets we plan to launch. This app will allow users access multiple financial services at low costs compared to what is currently available in market”, Jones added.

Commentary: We have seen this playbook before. Fintech startups start-off at one end of the financial services curve providing niche services like lending and then expand to do every other thing.

In March 2019, Carbon secured a $5 million debt facility from Lendable and then rebranded to become a digital financial services platform.

Comments ()