How DeFi can facilitate better access to financial services in Africa

DeFi has huge potential to facilitate access and inclusion to financial services such as lending, investing, settlements, online transactions, payments and so much more, provided the infrastructure gap is closed. How can defis elevate financial services in Africa?

DeFi can potentially accelerate access and inclusion to financial services such as lending, investing, settlements, online transactions, payments and so much more in Africa.

The blockchain is a hallmark of computing and innovation. Its decentralized nature allows the creation of self-executing, autonomous, and immutable software that no one authority has over, not even the original developer(s). One area that is seeing a lot of promise is fintech solutions. With the notoriously fragmented nature of banking in Africa, DeFi holds a lot of promise in the continent.

Africa is home to some of the fastest-growing economies in the world, and with a demographically youthful population, the stage is set for the needed disruption in financial services and technology.

The continent leads the world in mobile money adoption, with digital transactions in Africa accounting for over 45% of mobile money transactions globally, helping to serve the unbanked and underbanked all over the continent.

Major players like Kenya's Safaricom with Mpesa and Ghana’s MoMo are among the leaders in this financial revolution.

Despite all this growth, centralized finance or CeFi still controls much of digital finance in Africa. This means that banks, governments institutions, and other traditional institutions are still responsible for most of the infrastructure through which the digital banking revolution is taking place.

This structure is highly fragmented and innovation-wise, is at a huge disadvantage. This is why fintech normally has to build apps and API to tap into this infrastructure, more often than not, face service downtimes due to the relative instability of the digital infrastructure in CeFis.

The adoption of decentralized finance in Africa

The last decade has seen phenomenal growth in the African fintech startup scene.

They have not only been a viable alternative to traditional banking options in both urban and rural areas, but they have also even supplanted traditional institutions in some places.

This is, however, no coincidence. In Africa, fintech has created an enabling environment for thousands of merchants, small businesses, and consumers to thrive and get access to diverse financial solutions in a fast-changing and competitive world.

Fintech startups have opened up the financial sector value chain and have improved financial inclusion, innovation, and productivity across Africa.

The European Investment Bank, in a study, pointed out that Sub-saharan Africa had one of the highest bank account ownership stats in the world. The study also points out that digital financial services have been heavily subscribed in rural areas where access to traditional banking is limited.

In Kenya, according to the 2019 FinAccess Household Survey, 82.9% of Kenya's adult population has access to at least one financial product. This high rate of financial inclusiveness has created numerous opportunities in open banking for SMEs in Kenya.

In 2019, Kenyans moved a record Sh4.35 trillion through their mobile devices as gathered by the Central Bank of Kenya (CBK), a Sh361.39 rise following the previous year. Further insight into CBK data revealed that mobile money transactions represented 46.1% of the estimated size of Kenya’s economy (GDP).

Despite exceptional progress, fintech will always still be hampered by the lack of innovation in this centralized financial system. They can only innovate as fast as the traditional institutions can accommodate, and it is usually quite difficult to build beyond this system.

This is where decentralized finance comes in. Decentralized finance has come a long way from being an obscure term only understood by computer nerds. Although still in its nascent stage, it has the potential to unlock a new industry within the African financial ecosystem.

Some important ways in which decentralized finance is being used to solve problems in Africa include

- Crypto trade: Cryptocurrency trading has taken off in Africa. Now it is not only Bitcoin, Ethereum is the second-largest cryptocurrency by valuation in the world, and is also the second most traded cryptocurrency in Africa. Stablecoins like USDT and USDC have also seen a massive upsurge in trading due to inflation and cross-border trading. Take Nigeria for instance, trading volumes on Paxful exceeded N92. 25bn ($225m) between March to June 2021. A significant part of the volumes was from users trading stablecoins, especially for safekeeping and cross-border trade.

- Currency devaluation: XendFinance is a Nigerian startup building DeFi applications to solve the problem of currency devaluation and savings for credit unions. Credit unions are one of the most popular cooperatives for saving, investment, and lending in Africa. However, centralized finance means that the value of money is kept as fiat, prone to devaluation and inflation due to market forces. By allowing members of credit unions to access DeFi for their members by using decentralized stablecoins such as DAI and BUSD, they are hedging against inflation and currency devaluation.

- The Sarafu network in Kenya is building a community inclusion token that enables economic activity and peer-to-peer even on USSD. This creates possibilities for the tokenization of assets to unlock wealth from land, mineral rights, and future earnings from contracted revenue.

- Crypto Investing and saving: Joining the likes of global cryptocurrency exchanges like Binance, African crypto startups like Buycoins and Bundle are allowing investors to save their money in decentralized stablecoins for investment. This means they essentially have a tokenized dollar to allow them to build a portfolio and if needed, exchange at flexible rates for fiat currency. Also, coin locks are available to allow users and investors to keep their coins, including stable coins safe when not needed for immediate use. These financial solutions can go a long way in growing income, promoting a viable middle class, and preventing inflation that will erode one’s portfolio.

The Potential of DeFi in Africa

The possibilities for DeFi in Africa are limitless. Innovations such as smart contracts and decentralized blockchain can create whole industries with products developed to tackle various diverse needs.

Take for instance smart contracts and e-commerce. With the exponential growth in online trading and e-commerce, smart contracts can be a viable, smart, easy, and decentralized way of facilitating online transactions.

There are lots of possibilities regarding smart contracts and e-commerce. Online trade and transactions will only get bigger, and it means the issue of security for both parties will always become more paramount. A situation where smart contracts can easily be deployed to cover situations such as e-commerce, contracts of different types including employment contracts, tenancy agreements, payments, online retail, freelance agreements, cross border transactions, and tokenized commerce.

Another big area where DeFis can be deployed in Africa is lending. Africa has seen an uptick in micro-lending platforms and lend tech startups empowering Micro and small business and individuals with quick loans. However, these platforms have come under criticism for their arbitrary lending processes, lack of accountability, and how they shame credit defaulters.

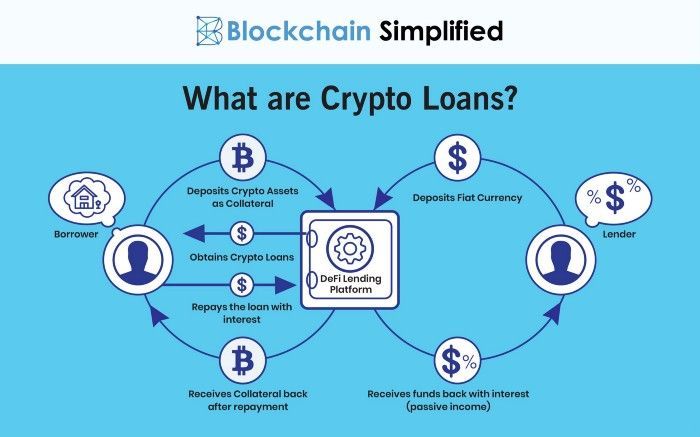

Crypto loans are collateralized or uncollateralized loans given to a borrower in exchange for his crypto assets as collateral or no collateral at all. This way, the borrower obtains fiat loans from lenders in place of his crypto assets, which act as securities in absence of repayment of the loan.

The exchange of crypto loans also only happens between the lender and the borrower once both parties accept a specific interest rate on the loan. Once the amount is paid back in full, the lender releases the collateral that acted as security. These crypto loans are typically carried out on DeFi lending platforms where lenders and borrowers can interact directly without the presence of any intermediary.

They also have the possibility of creating a decentralized loan system like AAVE or dYdX in which the participants will provide liquidity to earn a profit on interest, and businesses can lend loans to grow.

But for crypto loans to have a mainstream effect in Africa, the loans have to be majorly uncollateralized. Interestingly, UTU a startup in Kenya that is testing out uncollateralized loans with DeFi.

DeFi investing or staking/tokenized stocks holds an interesting promise for Africa wealth tech platforms. Jude Dike, founder of startup investment platform Getequity notes to Benjamindad.com that tokenized equity powered by DeFi have massive potential for growth and startup investing in Africa. Getequity allows investors to buy equity in startups, so a tokenized security powered by blockchain technology that is self-executing and immutable would be a big win for the ecosystem.

Challenges to DeFi adoption in Africa

The knowledge gap is a big problem. There is still so much sensitizing to be done, as most Africans have no idea about decentralized systems, never mind how they work. There are also regulatory bottlenecks. African regulators are loathe to accept any technology that fundamental challenges their control of the financial system, with Nigeria a good example.

The infrastructure is still not there yet to deploy these technologies at scale and it would take a concerted effort from all stakeholders to see this through. Still, a lot can be gained by widely adopting this technology, as it could propel financial inclusion and digital solutions at the scale never before seen in the continent.

Comments ()